Gauging the Risks of a Wage-Price Spiral

Total nonfarm payroll employment increased by 263,000 in September and average hourly earnings (measure of wage growth) rose at 0.3% in August, and 5% on a year-on-year basis.

While these numbers were broadly in line with expectations, the market focused on the unexpected collapse in the unemployment rate, exacerbated by the drop in the participation rate. A very tight labour market, combined with broad based inflation, is increasing the risk that prices and wages could start feeding off each other and accelerate, leading to a wage-price spiral dynamic.

But how material are these risks?

Wage-Price Spiral Risk

On this point, I would like to pick up on a recent work, published by the IMF, “Wage-Price Spiral Risks Appear Contained Despite High Inflation“. The study analyses 22 situations, out of a sample of over 30 advanced economies, with conditions similar to 2021: 1. Rising inflation 2. Positive wage growth 3. Negative real wages and 4. Flat or falling unemployment. Overall, historical evidence, gathered on data spanning over 50 years, shows that these episodes, characterized by about a year of accelerating prices and nominal wages, have not generally lasted.

Source: IMF World Economic Outlook

Three pre-conditions, however, are critical for inflation to finally recede: Supply-side Shocks fade, Real Wages remain subdued – at least until inflation starts to come off-, and Inflation Expectations remain well anchored. This last aspect is particularly relevant from the Central Banks’ perspective, because inflation expectations significantly influence the persistency of the wage-price feedback loop. The following chart plots the impulse response function, calibrated on historical evidence, of inflation expectations (12 months ahead) to one standard deviation in the Global Supply Chain Index conditional on the strength of inflation anchoring.

While forward measures of inflation quickly revert to the Central Bank’s target when policy action is credible, the opposite is true when there is limited confidence in the Central Bank’s ability to restore price stability. In the first case, in fact, inflation expectations come back to the central bank’s target in about 1 year, while in the second case, it takes much longer, on average about 3 years.

Our Gauge of Price-Wage Spiral Risk

I went through the exercise of building a relatively simple scoring system based on a few measures of stress across the Global Supply Chain, the US Labour Market and Market-based Inflation Expectations. Let’s take a closer look at their recent development in what follows.

Global Supply Chain Pressure Index (GSCPI)

Let’s start from supply chain disruptions, which have been the patient zero of the inflationary wave. The GSPCI Index has been built with the aim of providing a summary of potential supply-side shocks by integrating a number of commonly used metrics of shipping and airfreight and supply chain-related components from PMI of the US, China, Japan, Taiwan, the UK and the Euro area.

Source: Federal Reserve Bank of New York

The data shows that disruptions are gradually easing, and they seem to be reverting to pre-pandemic levels.

Real Wage Growth

Hourly earnings are growing at 5% year-on-year, well below the US CPI year-on-year. Real Wages remain negative when seen through the lens of the CPI, but they are roughly in line with the core PCE inflation rate. This number is still too high for the FED, which probably wants to see these figures returning to a level which is much closer to their long-term inflation target of 2%.

Source: Compound, Bilello

Total Nonfarm Quit Rates

Quit rates are also an important gauge of wage pressure. There is in fact a strong positive relationship between the share of employed workers quitting their jobs and the rate of wage and price inflation. High quit rates significantly increase companies hiring costs.

While these numbers are still very high on an historical basis, they have made a come-back since the peaks reached in December 2001.

Goods & Services Consumption Gap

The sudden shift in consumption between goods and services has been one important driver of inflation and tight labour markets. Demand reallocation seems to explain a significant part of inflation, and especially of its core and sticky component.

We are now experiencing a gradual stabilization in the gap between real personal consumption in goods and services. This could become a significant factor helping companies in their hiring and production planning.

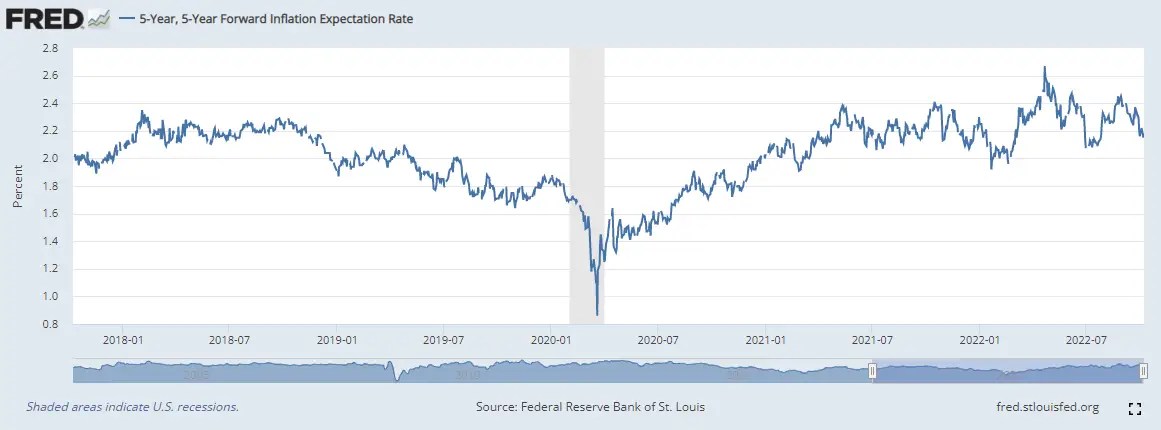

Inflation Expectations

There are many ways to visualize and monitor the dynamics of inflation expectations. But, I found that the 5 year-5 year forward inflation rate may be a reasonable gauge on what the markets think about inflation persistence.

Over the past few months, this forward-looking measure of inflation has been coming off, and it is now at levels which are very close to the 2% target.

Bottom Line

Consistently with the IMF analysis, I find that in this framework the risks of a price-wage spiral are low, although not completely negligible. The market implications are that the current market pricing of the terminal rate between 4.5%-4.75% is probably consistent with the current macro backdrop, and it may add to the case for a slower hiking pace in December and in February.

Next week, the inflation number it will be crucial and will give us further clues on the short-term price action. A high inflation number may push the terminal rate higher, close and maybe slightly above the core inflation figure of around 4.9%. But I think that the big adjustment, at least in the rates market, has already happened. We are now not far from levels where we can see a stabilization in the pricing of the terminal rate. On the other hand, a lower-than-expected inflation number, especially on the core inflation front, may come as a relief, and it may be a turning point at least for a few weeks.

Disclaimer

All views expressed in this site are my own and do not represent the opinions of any entity whatsoever with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site, and there is no guarantee for completeness or accuracy. The content is not meant to be a solicitation to trade or invest. Readers should perform their own investment analysis and research and/or seek for the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics.

Leave a Reply