Stocks rise, rates rise and bonds keep falling – again; notable angst about Fed Funds’ peak and terminal rates and possible recession. Watch out for the first earnings of 2023 with Oracle on Thursday After Close. On Friday, February’s NFP.

Major market events 6th March – 10th March 2023

Highlights for the week

Mon: EU Retail Sales, US Factory Orders.

Tue: CN Exports, CN Trade Balance, Fed Chair Powell Speaks.

Wed: German Retail Sales, EU GDP, US ADP Non-Farm Payrolls, Fed Chair Powell Speaks, JP GDP.

Thur: US Jobless Claims.

Fri: BoJ Interest Rate Decision, German CPI, US Non-Farm Payrolls, US Unemployment Rate.

Performance Review

Bounce, bounce, bounce. When you’d least expect it, considering that yields are still under pressure. At some point during the week, there wasn’t a bond on the US Yield Curve whose handle didn’t start with a 4. What happened last week was mainly China reporting some positive data hinting at a global recovery, and three crucial tech companies (Zoom, Salesforce, and Okta) reporting good earnings and giving a positive outlook. In particular, Salesforce attributed key importance to the recent headcount reduction as a predictor of better results and returns. In the US, 6 months bills had yields greater than 5% – is this a sign of a recession? (Nope.) Nomura is calling for a 50bp hike on March 22, but my view is that such a move would be i) highly unusual and ii) potentially sending the wrong message about being on top of things. It will be 25 bps once more, perhaps keeping the door open for one more hike down the road (this is the ‘higher for longer’ that the January NFP brought us). Max thinks that the February NFP, coming in this Friday, is going to be weak, and such a result would be taken positively by the market, I think. In Europe, the dramatic struggle against rising bond yields continues. ECB’s Francois Villeroy de Galhau said that he believes that the ECB will hit the peak rates in September. Goldman Sachs is forecasting the ECB to reach a top in June, with a hike of 50 bps in May. If that were true, I can hardly understand the hype in European bond yields we are having, even though Max thinks that Europe’s inflation has become structurally higher than it was in the past because, unlike the US, is not independent in Energy, and there are obviously constraints to that end with the war still ongoing. But the economy has never been as dynamic; besides, for some countries, we are approaching yields that were never seen since 2011, during the so-called ‘Euro crisis’. Enough is enough, although we certainly have a few more bumpy months until we reach the top in rates. At the moment, the higher tail risk that I see is inflation remaining higher for longer, although we have been seeing a slower demand for workers in the US, which brought Max to issue his careful stance on the NFP. Come March 10th we’ll finally have some answers, so fasten your seat belts and sit tight …

Source: Topdown Charts, Refinitiv Datastream

To say that nothing worked in February would be an understatement. It looks as if we went back to 2022, with both equities and bonds declining. Indeed only cash had a positive return for the month, and markets were pretty much risk off. This is the consequence of January’s strange (seasonal?) NFP. By next Friday we’ll have confirmation on whether this was just a one-time blip – or if we should start worrying seriously (about higher rates, not about recession).

Checking up on the economy: the good

The ‘good’ points to more sustained growth, albeit at the cost of higher rates (the ‘higher for longer’ moniker that is soon becoming a mantra). According to some indicators, the economy seems to be doing well enough, though forecasts vary considerably amid the different investment banks. For starters, it can be helpful to look again at this chart from Goldman Sachs, which is more optimistic than the consensus on 2023 GDP for the US. Note that the consensus expects negative growth in 2Q23 and 3Q23, hence pointing to a recession (albeit the shortest one possible).

Source: Goldman Sachs

Goldman Sachs’ optimism is echoed by the Atlanta Fed GDPNow real GDP Estimate for 1Q23, which sees a growth of 2.3%. I further note that the average of Blue Chip Consensus, while far away from that projection, has turned positive and so we are getting further away from a recession.

Source: Blue Chip Economic Indicators and Blue Chip Financial Forecasts

We also have an updated chart from the Citi Economic Surprise Index, which continues to be stronger than expected. While this in turn would mean higher rates, I believe it is already discounted by the terminal rate being > 5.25%.

Source: Citi

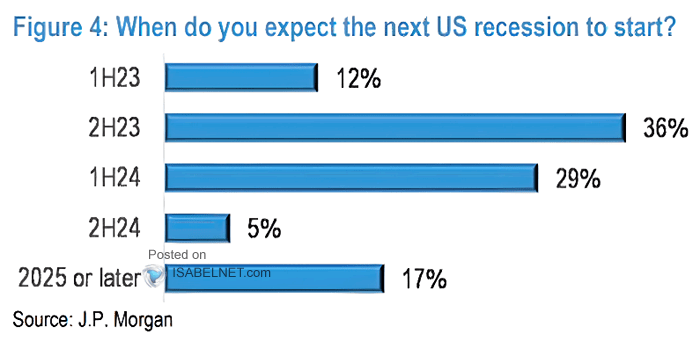

Finally, I would add that Maesk’s CEO is not worried about a recession in the US. This seems to be echoed by a recent survey of portfolio managers done by J.P. Morgan in which most expect the recession to come at a later time, or not at all (2025 or later). Again, 2H23 is a consensus opinion, but I would highlight that it would stem from negative growth in 2Q23 and 3Q23. The real question is what would be the impact on earnings’ growth – easier said than done!

Source: J.P. Morgan

Checking up on the economy: the bad

Let’s start with the elephant in the room – the peak rate target and what will the Fed do in March. The debate is on either a 25 bps or a 50 bps hike; Nomura (chart below) is in the latter camp and I disagree. Hiking by 50 bps would send all the wrong messages, and the most worrying of all would be that the Fed is behind the curve. It does not make sense to reaccelerate their hiking cycle after just one session? It would also mean that they are worried to lose control of the economy. No, 25 bps it is, and certainly, they might leave the door open to more hikes down the road if the data warrants it. That said, we are certainly looking at a higher peak rate – possibly as high as 5.5% given the information we now have, and a higher terminal rate. That is the other consequence plotted by the Nomura chart with which I agree – no cuts in 2023. The Fed will probably be done in June, and barring any disaster it is unlikely that it will start cutting just shortly after having finished its hiking cycle.

Source: Federal Reserve, Nomura

After we have taken care of the main issue, let’s go to the second one: valuations. Stocks are expensive, and investors have real alternatives where to put their money. The current yields are pressuring the Equity Risk Premium and it’s difficult in this environment for equities to shine. On top of that, higher rates slow their fundamentals so corporates are under a double whammy. Perhaps going back 100 years, as Bank of America does, is a bit too much, even though I agree with its view that such challenging macro conditions pressure the multiple, which can only keep afloat if earnings continue to be plentiful. This takes us to issue number three …

Source: BofA Global Investment Strategy, BofA US Equity & Quant Strategy

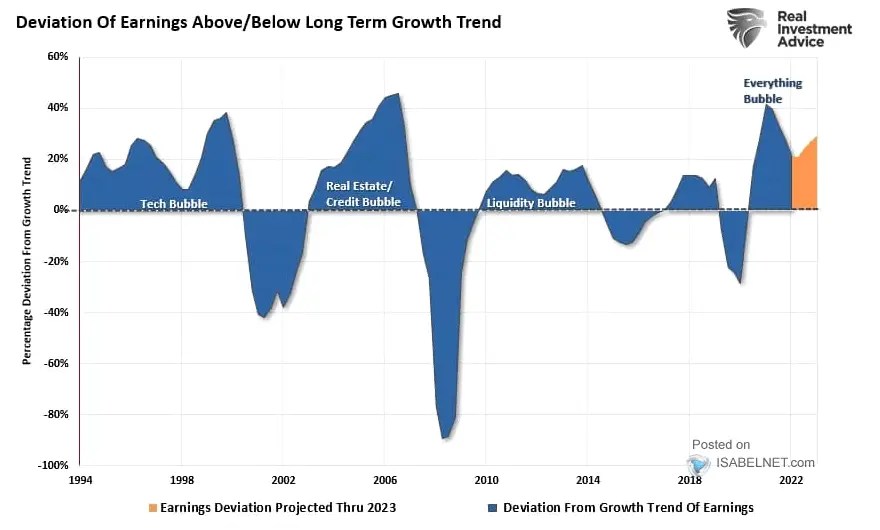

Earnings! It looks like US Corporates produced the best results possible under the current scenario; the question from here is if they are able to continue down that path. Earnings at the moment are above average, and the rates’ picture isn’t friendly. However, some significant technology companies were able to impress last week, so perhaps there is hope. We’ll check the pulse of current earnings later!

Source: Real Investment Advice

On the macro side, the job differential is strong, meaning that there will be unlikely a drop in employment. I put it here in the bad because it means higher rates (which the market does not want), although it is further evidence of the strength of the economy. Max however thinks January’s NFP was heavily influenced by seasonality and February’s going to turn out below consensus.

Source: The Daily Shot

Checking up on the economy: the ugly

So earnings are mean reverting and are also extended relative to their long-term trend. That is an additional headwind for the market. Were these start to fall, we would get to the Morgan Stanley Scenario – $195 and S&P 500 at 3,000. Yikes! This is why checking them is so important.

Source: Real Investment Advice

But that’s not the only indicator that raises eyebrows, unfortunately, The inverted 10 Year- 2 Year curve is also pointing to a recession, and has an excellent track record in predicting those. This time is different? I hope so, but it pays to be careful.

Source: Bloomberg Finance L.P.

We are in the third year of an Election Cycle. While bull markets turn out fine, bear markets are quite terrible. Let’s hope that 2023, supported by the positive close in January, will be one of those positive years (despite the nasty February).

Source: Topdown Charts, Refinitiv Datastream

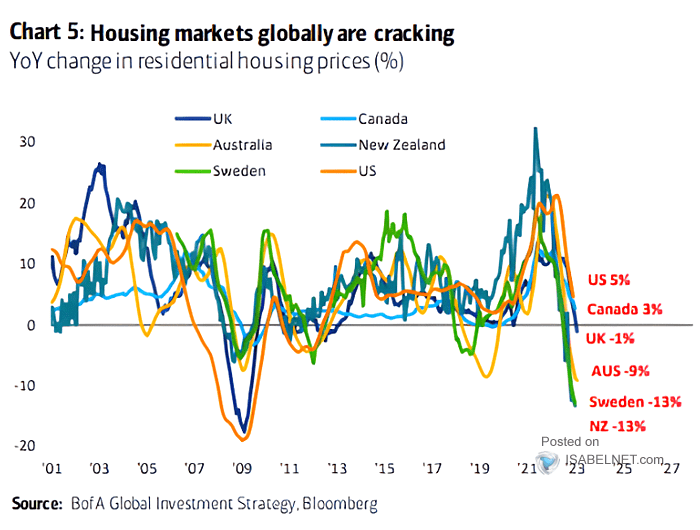

Finally, rates are having an impact on housing markets everywhere (except perhaps in central Milan, where prices always seem to be on the rise!). While higher rates are beneficial for savers, they are putting a cap on real estate. So much for Harrods’ CEO to say that he’s not worried about a recession because ‘the rich get richer in a recession’. So far the UHNWIs seem to be doing well, as legendary yacht maker Sanlorenzo can attest.

Source: BofA Global Investment Strategy, Bloomberg

Sentiment and what the market is telling us

The indicator paints a neutral picture, despite a positive week. The Fear and Greed Index is still in Greed territory, with a reading of 55, down from last week’s reading of 59. February’s turbulence – and the inability to make money except with cash – has damped some of the enthusiasm.

Source: CNN Business

Introducing the Euphoriameter, which returns a negative reading and one that appears far away from the recent performance of the S&P 500. The most critical component seems to be a lack of bulls.

Source: Topdown Charts, Refinitiv Datastream

What are the Flows telling us?

According to the below chart, equity investors aren’t particularly greedy, as only 35% are planning to increase their equity exposure, which is telling considering that there are plenty of other alternatives in which to invest (although none of them worked in February, including Equities, to be true).

Source: J.P. Morgan

Europe’s out of fashion? Certainly, it is dealing with more sticky inflation than the US (see also Market Considerations below). For now, investors seem to focus elsewhere and flows are fading.

Source: BofA Global Investment Strategy, EPFR

On the other hand, cash is king – and understandably so – given the great yields offered by the short end of the curve and the negative performance offered by everything else in February. But Wall Street’s strategists haven’t been increasing their allocation to cash accordingly, as the chart below shows.

Source: BofA Global Investment Strategy, EPFR

Source: BofA US Equity & Quant Strategy

Earnings Review

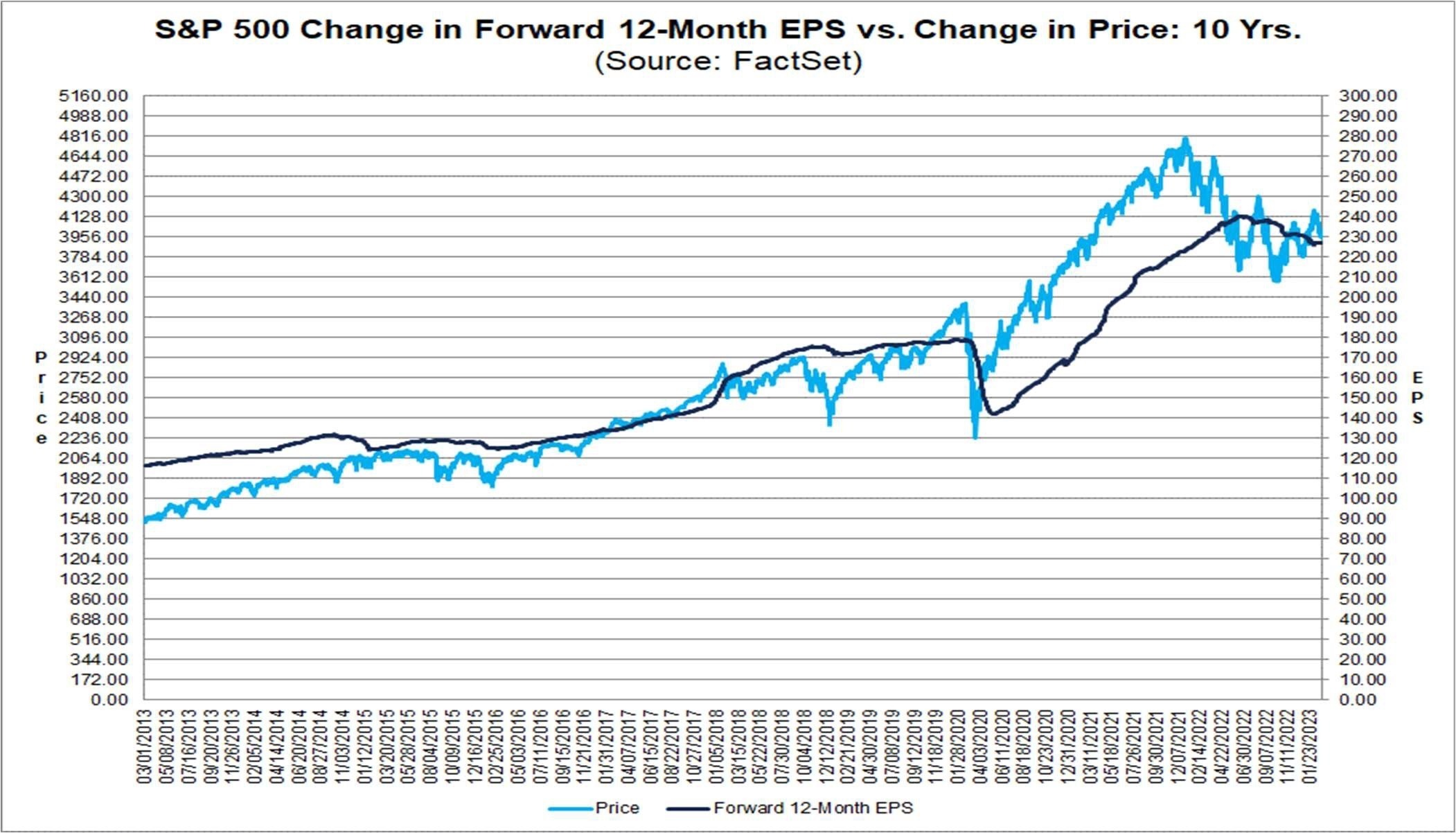

Source: FactSet

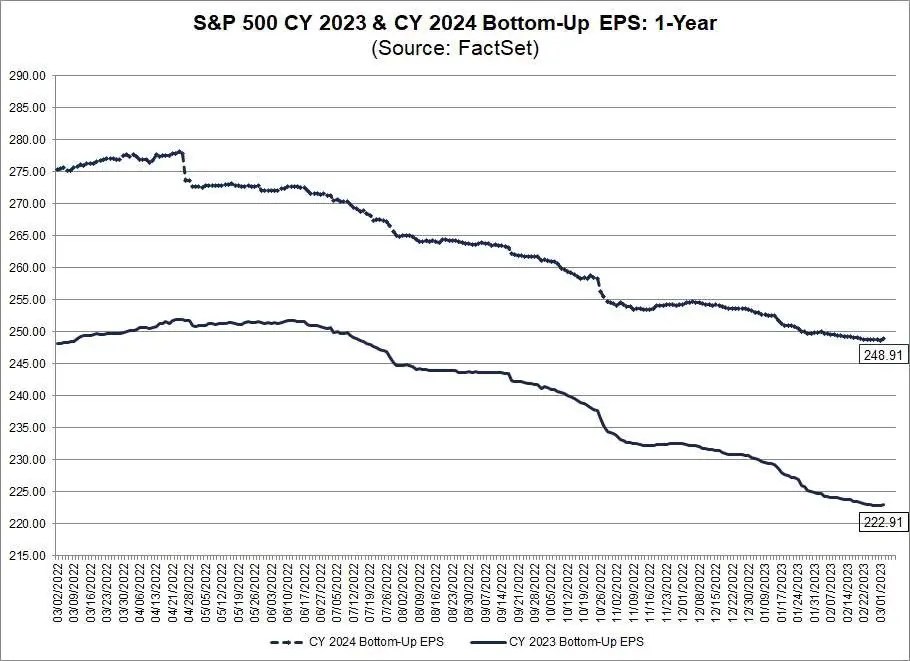

The forward 12-month P/E ratio for the S&P 500 is 17.5x, down from last week’s reading of 17.7x, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings eventually broke the $ 224 mark as roughly 99% of US Corporates have reported for 4Q22, even though last week’s earnings were good. As the reporting is nearing its end, the level of 2023 EPS is once again put into question. The present, bottom-up level is more or less level with Goldman Sachs’ top-down $224 forecast. As we have been going down steadily for a while, I just wonder if at some point down the year the US Corporates will find in them what it takes to reverse this trend, as forecasted to happen in the back half of the year. Certainly reaching the peak in rates – delayed by the NFP, CPI, and PPI – would help. Will see what this week’s NFP will bring.

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -4.6% – revised downwards from -4.8% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 2.1% year on year, again revised downwards from 2.2% last week. The cuts on the S&P 500’s earnings growth are getting significant: earnings growth has more than halved in just 9 weeks since December 31st. Ouch!

Source: Factset

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Utilities and – perhaps surprisingly – Communication Services; all the others are facing cuts. After a few disappointing earnings reports Technology has seen its earnings estimates reduced to a mere 1.0% from 3.5% a little more than a month ago.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.0% from 2.2% one week ago. Financials are still leading the pack in terms of revenue forecasts, but the only sectors with higher revenue growth than on 31 Dec 22 are Real Estate and Consumer Staples, with all others being down. Information Technology revenue growth has been cut to 1.9% from 3.7% one month ago. The sector seems to be doing better on the top than on the bottom line, perhaps signaling the reason for some of the layoffs.

Source: Factset

Let’s take a look at EPS for 2023 and 2024, which continue to have downward revisions on a weekly basis. The forecast for 2023 has now been updated to $222.91 from last week’s reading of $223.45; while 2024 is currently forecasted to be $248.91, compared to last week’s reading of 249.14. I look with much interest at further revisions as the 1Q23 report season gets underway in March

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than earnings at this point, the latter’s deterioration is continuing to get me worried as the downward revisions have been relentless and guidance very muted. It seems almost a miracle that the market managed to stay afloat with these shrinking earnings. As 4Q22 is almost over, March will see the beginning of the reporting for 1Q23, starting with Oracle this week, which I will be looking at with much interest.

Earnings, What’s Next?

The earnings season is now wrapping up its 4Q22 reports. Highlights this week include: Ulta (Thursday, After Close), Docusign (Thursday, After Close), and Oracle (Thursday, After Close), which will be the first company to offer a glimpse in the results of 1Q23.

Source: Earnings Whispers

Market Considerations

Revenue growth estimates for 2024 are forecasted to grow by 5.0% (4.7% on Dec 31st) and earnings growth estimates for 2024 are predicted to grow by 8.6% (6.5% on Dec 31st), so the future looks to be bright. While we continue to debate whether the US economy will fall into a recession or not (but even if there was one, it does look to be mild), we should focus – as I have for some time – on the relative value of American vs European assets. The chart above worries Max

– as he sees the European Inflation to be more sticky than the US one – in part because of the conflict in Ukraine and European’s dependence on foreign energy producers – and thinks it is not positive for European Risk Assets.

We are approaching the NFP by the end of next week, and once again it will have the power to swing the pendulum in one way or another. Tactically I suggest being neutral on risky assets until Thursday evening, keeping in mind the S&P 500’s 2nd February peak of 4,179.76 as a level which – if broken – would prompt me to re-enter the market. For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx 4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a valid compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling. 10-Year yields were turbulent last week, both in the US and Europe, though the ceiling should be near for both. For those wishing to keep their money in Equities, suggest switching to Japan (the country with the clearer picture on rates at the moment) until rate perspectives become clearer in the US and Europe.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply