Rates rise, stocks fall – again; Fed Funds’ peak and terminal rates adjusted further. US and EU equities down, JP holding better. On Friday, February’s NFP.

Major market events 27th February – 3rd March 2023

Highlights for the week

Mon: US Core Durable Goods Orders, US Pending Home Sales.

Tue: US Consumer Confidence.

Wed: German Retail Sales, German Unemployment, German CPI, US Manufacturing PMI.

Thur: EU CPI, US Jobless Claims.

Fri: US Non-Farm Payrolls.

Performance Review

And then there was blood. So much for the easy and constructive start to the year. All equity markets were under significant pressure, with the notable exception of Japan. My view is that while a storm is brewing on rates it is daunting for equities to make any meaningful progress. The fact is, the NFP first, the CPI and PPI later, and finally Retail Sales, have completely repriced the peak rate and the terminal rate, shifting the yield curve higher and farther out. Add in rather disappointing earnings (with the notable exception of Nvidia) and the current environment is harsh and difficult in the US. In addition, the Fed minutes show that the board of Governors thinks that more hikes will be needed to tame inflation, hinting at hikes in March, May, and June, with the market having almost priced a 25bp hike in all three meetings. In Europe, higher-than-expected inflation puts pressure on the ECB to continue its hiking, so a 50bp hike at the next meeting in mid-March is now a given, taking the rate to 3.5% – still much lower than in the US. In Japan, Kazuo Ueda was appointed to the post of Governor of the Bank of Japan in April when Kuroda’s term ends. He is still expected, at least in the very beginning, to continue the policies of easy liquidity initiated by his predecessor. The current narrative has bifurcated into those who believe that inflation is here to stay and hence higher rates are warranted and those who believe that the economy will fall into a recession, leading to lower rates. So far I am firmly in the first camp, even though the indications we have are inconclusive. After yet another turbulent week in fixed income, my advice is still to buy bonds – particularly on the short end. However, I do think that the peak in rates is not too far away, even with the target having been pushed forward by recent, less benign, data. In the end, while prices will continue to go up and down, my advice is to choose a yield that you are comfortable with – particularly if it is > 4% and in a major currency, and stick to that. Though for last week’s pattern, an iconic quote from Sting sounds appropriate: It’s a big enough umbrella, but it’s always me that ends up getting wet. Hang in there (I know, it isn’t pretty!).

Checking up on the economy: the good

I had to look hard for some positive news in a week in which there wasn’t much. The Truck Tonnage Index rose by 0.7% in January – a positive outcome considering that the S&P 500 tends to rise in line with the expansion of the economy. That’s another positive sign that the economy, so far, is not in a recession.

Source: ISABELNET.com

Another valuable piece of information was that so far, the short interest on US stocks is very limited – so not many shorts pressing the market. Indeed, as I have said, There Are Real Alternatives and so it’s mostly a matter of asset allocation. I guess the relatively light short interest goes in synch with the reduced expectations by market pundits that the US will go into a recession.

Checking up on the economy: the bad

Plenty of news, however, on the bad side. I guess that one of the worst is the repricing of the peak and terminal rate, to higher levels and farther out. Rates are clearly dominating the picture, and this is why next Friday’s Non-Farm Payroll is so important. This includes the Fed Funds probably topping in June at 5.5% (remember that just a few weeks ago we were discussing if the Fed was going to reach 5% at all), with one 25bp cut in December 2023, bringing the terminal rate in December 2024 to a level of 3.75%. I just wonder, if the economy is proving to be more resilient as I suspect, will the terminal rate be repriced higher and farther out? My gut feeling is that it is going to be the case.

Source: BofA Global Investment Strategy, Bloomberg

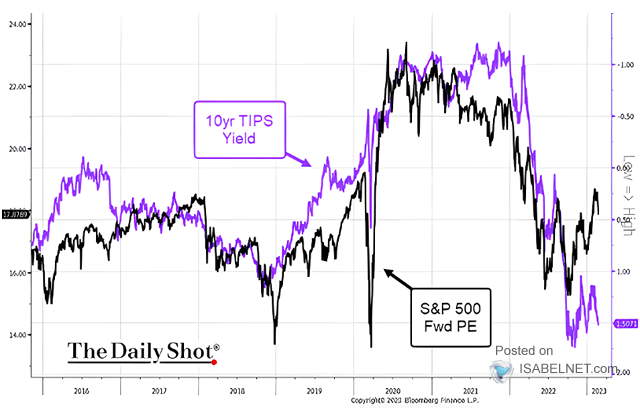

And if we weren’t convinced enough that negative rates were damaging the stock market, here’s proof: higher real rates are having an impact on the S&P 500.

Source: The Daily Shot

To end the picture on rates, the current probability that the US may enter a recession, deduced from the yield curve, is greater than 60%.

Source: Federal Reserve Board, Federal Reserve Bank of Cleveland, Haver Analytics

But the issues do not, unfortunately, stop with rates. On a channel check of the state of the economy, the chart below reports that Manufacturing is falling.

Source: S&P Global, The Daily Shot

And, as margins are being compressed, US Corporates hire less. Recall that although margin estimates by analysts have been trimmed, they still forecast record levels.

Source: NABE Business Conditions Survey, Bloomberg

Moving on to the market, I found that earnings growth, while above the long-term trendline, is still quite extended.

Source: Real Investment Advice

Though my greatest worry is seeing bottom-up earnings shrink continuously week after week. According to the chart below, growth should be negative in the first half of the year while rebounding in the second half. Recall that Goldman Sachs has a more optimistic view of the US GDP.

Checking up on the economy: the ugly

Let’s start with the elephant in the room: stocks aren’t cheap. To even keep the current valuation, the economy should not go into a recession and earnings growth has to start to fall (though they might not happen until the second half of the year).

Source: FactSet, Haver, Goldman Sachs Global Investment Research

And if you were wondering what could happen to earnings in a recession, the answer is nothing good, as the chart below shows. This could see the S&P 500 bottom at a level of 3,120 according to Goldman Sachs, a level that almost echoes the level of 3,000 forecasted by Morgan Stanley’s Michael Wilson. Recall that Goldman Sachs’ top-line EPS forecast for 2023 is $224, JP Morgan’s $205, and Morgan Stanley’s $195.

Source: Goldman Sachs Global Investment Research

I mentioned last week that Equities are also out of synch with bonds; the correlation has turned negative. Particularly in the current environment, it would be important if the correlation were positive – as lower yields are positive for stocks. This is further evidence of the decoupling.

Source: The Daily Shot

Sentiment and what the market is telling us

The indicator paints a mixed to negative picture. The Fear and Greed Index is still in Greed territory, with a reading of 59, down from last week’s reading of 69. No wonder last week’s market retracement has damped some enthusiasm.

Source: CNN Business

What are the Flows telling us?

It was a negative week for Equity funds in the US, with a net outflow of -$6.72Bn. Last week’s mild inflows were trumped by this week’s outflows which clearly state that investors have plenty of alternatives where to put their money, and they do prefer a less risky environment.

Source: EPFR Global

Clearly, investors’ preferences benefitted Government and Corporate Bonds, and particularly the Money Market, buoyed by the rich yields offered by the short end of the US Curve. We still have to be reminded that these are below the current inflation, so real yields are still negative.

Source: Datastream, Haver Analytics, EPFR, Goldman Sachs Global Investment Research

The chart below offers another picture of the rotation and where the outflows from US Equities went:

Source: EPFR, Goldman Sachs Global Investment Research

Finally, the rise of the US Dollar is having an impact on Emerging Markets’ Debt flows, also a risk-off move:

Source: BofA Global Investment Strategy, EPFR

Earnings Review

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 17.7x, down from last week’s reading of 18.0x, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings eventually broke the $ 224 mark as roughly 94% of US Corporates have reported for 4Q22. As the reporting is nearing its end, the level of 2023 EPS is once again put into question. The present, bottom-up level is more or less level with Goldman Sachs’ top-down $224 forecast. As we have been going down steadily for a while, I just wonder if at some point down the year the US Corporates will find in them what it takes to reverse this trend., as forecasted to happen in the back half of the year. Certainly reaching the peak in rates – delayed by the NFP, CPI, and PPI – would help. Will see what next week’s NFP will bring.

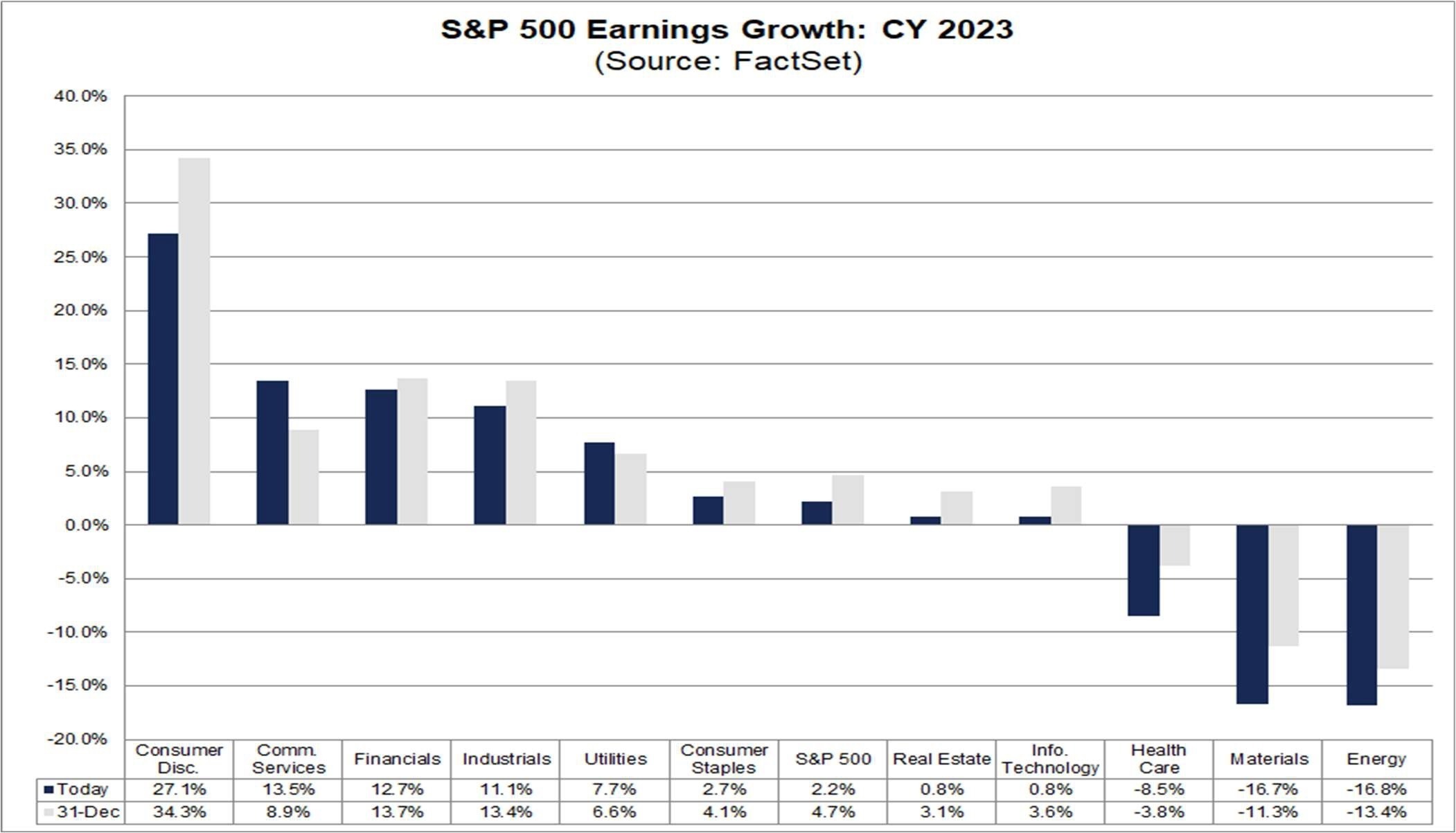

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -4.8% – revised downwards from -4.7% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 2.2% year on year, again revised downwards from 2.3% last week. The cuts on the S&P 500’s growth are getting significant: earnings growth has more than halved in just 8 weeks since December 31st. Ouch!

Source: Factset

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Utilities and – perhaps surprisingly – Communication Services; all the others are facing cuts. After a few disappointing earnings reports Technology has seen its earnings estimates reduced to a mere 0.8% from 3.6% a little more than a month ago.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.2% from 2.3% one week ago. Financials are still leading the pack in terms of revenue forecasts, and are one of a few sectors (together with Consumer Staples) to have a higher or equal revenue forecast relative to the end of 2022, with all other sectors being down. Information Technology revenue growth has been cut to 2.0% from 3.7% one month ago. The sector seems to be doing better on the top than on the bottom line, perhaps signaling the reason for some of the layoffs.

Source: Factset

Let’s take a look at EPS for 2023 and 2024, which continue to have downward revisions on a weekly basis. The forecast for 2023 has now been updated to $223.45 from last week’s reading of $223.77; while 2024 is currently forecasted to be $249.14, compared to last week’s reading of 249.30. I look with much interest at further revisions as the 1Q23 report season gets underway in March

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than is about earnings at this point, the latter’s deterioration is continuing to get me worried as the downward revisions have been relentless and guidance very muted. It seems almost a miracle that the market managed to stay afloat with these shrinking earnings. As 4Q22 is almost over, March will see the beginning of the reporting for 1Q23, which I will be looking at with much interest.

Earnings, What’s Next?

The earnings season is now wrapping up its 4Q22 reports. Highlights this week include Zoon (Monday, After Close), Target (Tuesday, Before Open), Salesforce.com (Wednesday, After Close), Hewlett Packard Enterprise (Thursday, After Close), and Dell (Thursday, After Close).

Source: Earnings Whispers

Market Considerations

Revenue growth estimates for 2024 are forecasted to grow by 5.0% (4.7% on Dec 31st) and earnings growth estimates for 2024 are forecasted to grow by 11.5% (10.2% on Dec 31st), so the future looks to be bright. While we continue to debate whether the US economy will fall into a recession or not (but even if there was one, it does look to be mild), we should focus – as I have for some time – on the relative value of Treasuries vs US Equities. The US Yield Curve has yields greater than 4% all the way to 5 Years, offering what I think is very good value. While rising yields have hit those who bought bonds earlier on, I still stand with my recommendation, confident that

– at some point – inflation will waver and real yields will, once again, return to positive levels. The peak in rates, I believe, has been delayed just by a few months, and the Fed’s hiking cycle – which operates with a lag – will eventually tame inflation. In a recent survey, most of the participants expected inflation to be less than 4% by the end of 2023.

We are approaching the NFP by the end of next week, and once again it will have the power to swing the pendulum in one way or the other. Tactically I suggest continuing to keep the short position on the S&P 500 until Thursday evening, using the 2nd February peak of 4,179.76 as a stop. For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx 3.5-4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a valid compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling. 10-Year yields were turbulent last week, both in the US and Europe, though the ceiling should be near for both. For those wishing to keep their money in Equities, suggest switching to Japan (the country with the clearer picture on rates at the moment) until rate perspectives become clearer in the US and Europe.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply