More angst in the US following CPI and PPI in synch with NFP; rates up and Fed Funds’ terminal rate reviewed further. EU equities star market of the week. US earnings continue to disappoint.

Major market events 20th February – 24th February 2023

Highlights for the week

Mon: US Closed (George Washington’s Birthday), German PPI.

Tue: German Manufacturing PMI, German ZEW ,Economic Sentiment, EU & UK Services PMI, US Services & Manufacturing PMI.

Wed: German CPI, FOMC Meeting Minutes.

Thur: EU CPI, US GDP,, US Jobless Claims.

Fri: JP CPI, German GDP, France GDP, US Core PCE.

Performance Review

Much ado about … very little. The CPI and the PPI came in line with expectations, halting the expected continued inflation’s downfall. A positive report from Cisco managed to restore the Nasdaq’s luster and leadership. We now have three consecutive pieces of data which tell us that inflation is going to be hard to tame, and higher rates might be needed to do that as a consequence. Indeed there was even talk of the Fed considering hiking by 50 basis points in March, which I deem highly unlikely – especially since they have recently slowed the pace of their hiking. What is entirely possible, and even likely at this point in time, is that they will continue to hike by 25 basis points for longer than previously forecast. As a consequence, the terminal rate is now firmly above 5%, and expectations of rate cuts have shifted to 2024. It was somehow surprising for me to see Europe as the star market for the week, but the positive news about the economy not going into a recession might have helped. The current narrative has bifurcated into those who believe that inflation is here to stay and hence higher rates are warranted and those who believe that the economy will fall into a recession, leading to lower rates. So far I am firmly in the first camp, even though the indications we have are inconclusive. And yes, buy bonds – despite yet another turbulent week on yields. In the US, particularly on the short end, bonds offer terrific value in the current still clouded environment.

Checking up on the economy: the good

Source: The Daily Shot

Last week I spoke of Goldman Sachs being more optimistic than the consensus on prospects for US GDP growth in 2023 and cutting the probability of the economy going into a recession from 35% to 25%, warning however that a better economy might warrant higher rates. To be sure, Goldman’s forecast expects 2 more 25bp hikes in March and in May to reach a target of 5-5.25%, which is almost in line with what is currently priced by the market after the Non-Farm Payroll. This week Citi comes with an unexpected upside on its Economic Surprise Index, testifying to the strength of the economy, even though the conclusion is the same: the stronger the economy, the higher the rates. The Fed’s hiking cycle might not end in May as previously forecasted, as shown by the below chart.

Source: The Daily Shot

The problem is that Governor Powell has repeatedly said that the Fed might hike more than the market currently expects if inflation is stronger or takes longer to recede. While the market is incorporating all information we presently know, it is hungry for data that might tilt it in one direction or the other. The January Non-Farm Payroll was unexpected, and so, in a way, last week’s CPI and PPI. The problem is that we have to wait another month to get additional pieces of data (save for the Jobless Claims which we can track every week), leaving the market in a sort of limbo.

Source: The Daily Shot, Bloomberg

On the positive side, it is certainly remarkable to note that Economists are no longer forecasting the Eurozone to go into a recession, with positive GDP growth for 2023. The scenario might be different for the UK, for which Brexit increasingly appears a major cause of the persistent weakness in the economy. While I think the ECB will follow the Fed’s trend in rate hikes, at the last meeting Governor Lagarde somehow tempered her earlier hawkish comments, saying that QT will be used only if needed. Still, yields – particularly in the periphery – continue to be stubbornly high with little or no willingness to come down.

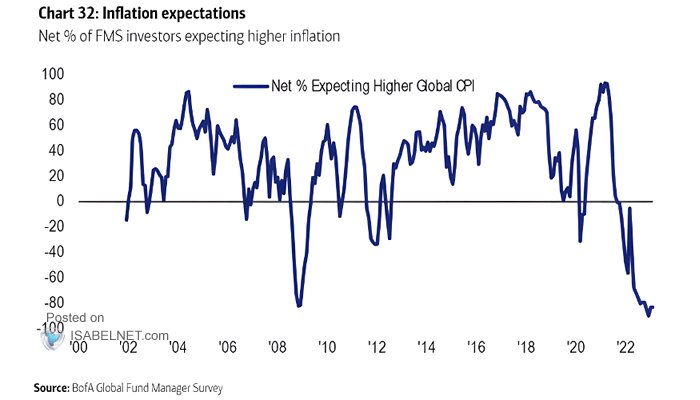

It looks as though inflation is no longer a concern, according to this survey from Bank of America. One other thing that has been striking this week is the weakness of the VIX in the US. It is almost as though inflation was to be expected and no longer a problem. But it still is on investors’ minds, as you will see in the chart posted below under market considerations.

Source: BofA Global Fund Manager Survey

Finally, a recession has never occurred with negative real interest rates, bolstering the case for further strength in the economy – but watch out for these declining EPS forecasts!

Source: Gavekal Research, Macrobond

Checking up on the economy: the bad

While the headline economy numbers seem to be doing ok, I wish the same could be said about earnings. We know that 4Q22 will be a quarter of negative earnings growth (the first one since the pandemic – 3Q20), but worries abound for 2023 with the current forecasts being trimmed week by week and already looking much lower than at the end of last year. (Luckily, 2024 is much more constructive, with the wall of worry concentrating on this year). It should come as no surprise that the S&P 500’s Equity Risk Premium is at its lowest since 2007; very low Equity Risk Premiums can foretell dismal stock returns for the coming years. At the moment, this, unfortunately, looks to continue, with earnings being constantly trimmed and with the 10-Year yield being pushed higher by the higher rates expectations.

Source: The Daily Shot

As we can see from the below chart, expectations have materially shifted higher since the January Non-Farm Payroll, and now the terminal rate lies between 5.25% and 5.50%, with possibly one rate cut before the end of the year. Will that prove to be the final forecast, or are there going to be further surprises along the way? Higher rates create a headwind for the equity market, and particularly for the technology sector.

Source: The Daily Shot

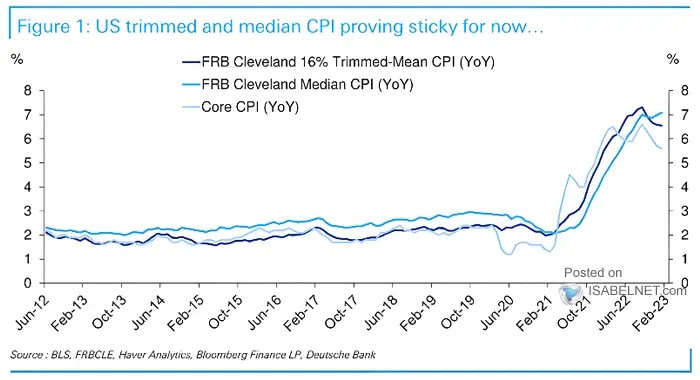

One of the problems is that inflation is not declining as it should, perhaps due to the time lag needed for the Fed’s hikes to bear effect. While the Core CPI has started to slow from the top, the median CPI and the mean CPI have yet to do so, pointing to higher rates. While the Fed is concerned with the strength of the labor market, economic data are its bread and butter. Most of us were fretting about the low unemployment rate because we thought that the CPI and the PPI would continue to fall. If they don’t, however, I’m afraid that everything will have to be reassessed.

Source: BLS, FRBCLE, Haver Analytics, Bloomberg, Deutsche Bank

Adding to the wall of worries, the US Leading Economic Indicator declined 0.3% in January, suggesting a recession for the US over the next 12 months.

Source: The Conference Board

Checking up on the economy: the ugly

Perhaps the most ominous reminder that the worst may not be behind us (as bad as last year has been) is the reminder that Fed tightening cycles end with an event. In practice, something cracks or gives way. This hasn’t happened yet.

Source: BofA Global Investment Strategy, GFD Finaeon, Bloomberg

On top of that, as we are constantly reminded, the S&P 500 is not a bargain. At 18x forward earnings, it is above the 10-Year average of 17.2x.

Source: Real Investment Advice

The S&P 500 has substantially diverged from real rates. This is a signal of tension that is about to brew, as shown by the following chart.

Source: The Daily Shot

Equities are also out of synch with bonds; the correlation has turned negative. Particularly in the current environment, it would be important if the correlation were positive – as lower yields are positive for stocks.

Source: The Daily Shot

Sentiment and what the market is telling us

This is a snapshot of the valuation of the sectors of the S&P 500 one by one. A large part of the market is trading above its 10-Year average, confirming the results for the headline number. On the basis of valuation alone, and not taking into account the falling commodity prices and the negative revisions to EPS, Energy seems to have the potential for appreciation.

Source: Goldman Sachs Global Investment Research, FactSet

Other indicators paint a more mixed to negative picture, to be honest. The Fear and Greed Index is in Greed territory, and almost unchanged from last week’s reading of 70.

Source: ISABELNET.com

Introducing a new indicator that gives the same results. The Fear and Frenzy Sentiment Index is nearing frenzy, indicating that investors expect to make some relatively easy gains short term.

Source: True Insights

What are the Flows telling us?

It was a positive week for Equity funds in the US, with a net inflow of $0.52Bn. This would seem to be a risk on move, and a vote of confidence in the market, but it is challenged by the next two charts which give the opposite view.

Source: EPFR Global

Market practitioners have been selling Technology stocks, with the largest outflows since September. The curious thing to note is that then they were doing it from a position of weakness, and now they are doing it from a position of strength, While the Nasdaq has barely recovered a third of last year’s negative performance, it has reclaimed its leadership, even amid earnings deterioration and dismal performance from some of its bellwethers, a clear sign of risk-off.

Source: BofA Global Investment Strategy, EPFR

This has been coupled with the largest outflow from High Yield bonds, another risk-off signal. While it is true that yields have been climbing in the past two weeks both in the US and Europe, I still look at High Yield as a way to diversify and enhance the performance of a portfolio with relatively limited risk.

Source: BofA Global Fund Manager Survey, EPFR

Finally, looking at the Top 5 holdings and buys of leading hedge funds for 4Q22, one cannot fail to notice how prominently technology stocks feature in this list, together with select financials and media companies. Most of these are growth stocks, and they have to find again their mojo for the market to climb meaningfully from here.

Source: Economy Insights

Source: Economy Insights

Earnings Review

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 18.0x, in line with the 18.0x reading of last week, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings eventually broke the $ 224 mark as roughly 82% of US Corporates have reported for 4Q22. As the reporting is nearing its end, the level of 2023 EPS is once again put into question. While the present level is more or less level with Goldman Sachs’ $224 forecast, other houses have a much lower level in mind: from JP Morgan’s $205 to Morgan Stanley’s $195. As we have been going down steadily for a while, I just wonder if at some point down the year the US Corporates will find in them what it takes to reverse this trend. Certainly reaching the peak in rates – delayed by the NFP, CPI, and PPI – would help.

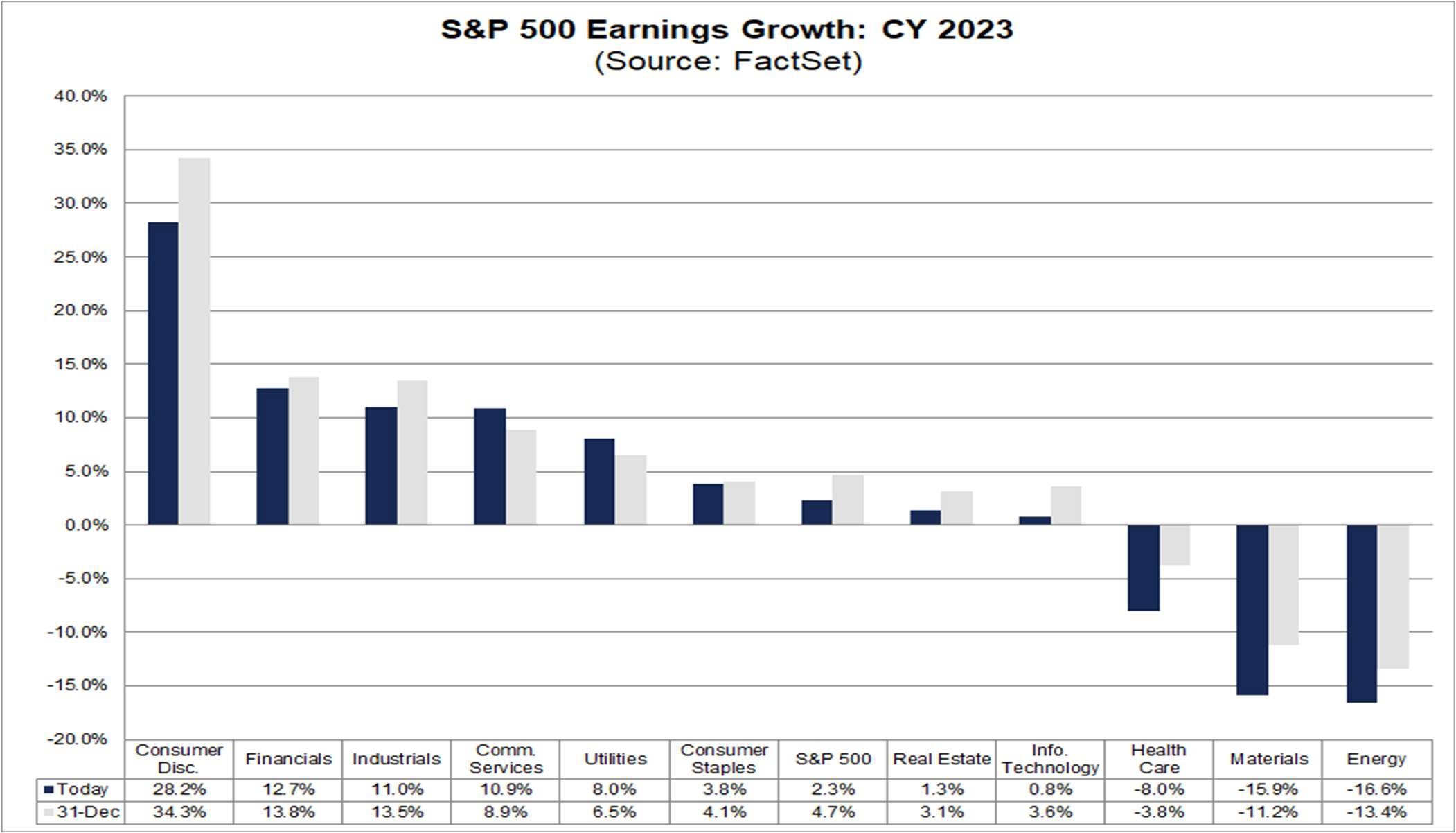

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -4.7% – revised upwards from -4.9% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 2.3% year on year, again revised downwards from 2.5% last week. The cuts on the S&P 500’s growth are getting significant: earnings growth has halved in just 7 weeks since December 31st. Ouch!

Source: Factset

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Utilities and – perhaps surprisingly – Communication Services; all the others are facing cuts. After a few disappointing earnings reports Technology has seen its earnings estimates reduced to a mere 0.8% from 3.6% a little more than a month ago.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.3% from 2.4% one week ago. Financials are still leading the pack in terms of revenue forecasts, and are one of a few sectors (together with Consumer Staples) to have a higher or equal revenue forecast relative to the end of 2022, with all other sectors being down. Information Technology revenue growth has been cut to 2.0% from 3.7% one month ago. The sector seems to be doing better on the top than on the bottom line, perhaps signaling the reason for some of the layoffs.

Source: Factset

Let’s take a look at EPS for 2023 and 2024, which continue to have downward revisions on a weekly basis. The forecast for 2023 – which has held steady since mid-November when the first figures ($ 229) were published – has now been updated to less than $224, Goldman Sachs’ target for the year; while 2024 has had a cut of the same measure from $ 254 to $ 249.30 I look with much interest at further revisions as the 4Q22 report season gets underway.

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than is about earnings at this point, the latter’s deterioration is continuing to get me worried as the downward revisions have been relentless and guidance very muted. It seems almost a miracle that the market managed to stay afloat with these shrinking earnings. I will be looking at next week’s report with much interest.

Earnings, What’s Next?

The earnings season is now entering in full swing its 4Q22 reports. Highlights this week include Walmart (Tuesday, Before Open), Home Depot (Tuesday, Before Open), Baidu (Wednesday, Before Open), Nvidia (Wednesday, After Close), and Alibaba (Thursday, Before Open).

Source: Earnings Whispers

Market Considerations

Source: BofA Global Fund Manager Survey

Revenue growth estimates for 2024 are forecasted to grow by 4.9% (4.7% on Dec 31st) and earnings growth estimates for 2024 are forecasted to grow by 11.4% (10.2% on Dec 31st), so the future looks to be bright. While we continue to debate whether the US economy will fall into a recession or not (but even if there was one, it does look to be mild), we should focus – as I have for some time – on the relative value of Treasuries vs US Equities. The US Yield Curve has yields greater than 4% all the way to 5 Years, offering what I think is very good value. Even the 20-Year Treasury provides a yield of 4.01% – guaranteed by the good old Uncle Sam and in USD – it’s a return I would love to have no matter what kind of inflation will face us in the coming years (as a reminder: most of us seem to have completely forgotten this, but we were in negative yields for quite a while).

Regarding the market, and with no immediate prospect of an improvement in earnings, I feel we will be in limbo until the NFP next Month. As a result, tactically I suggest going short the S&P 500, using the 2nd February peak of 4,179.76 as a stop – roughly 100 points or 2,5% above the present level. For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx. 3.5-4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a valid compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling. 10-Year yields were turbulent last week, particularly in Europe. Continue to prefer the US over Europe and Japan, even though the dollar deterioration can be a source of concern.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply