Terminal rate and risk repriced; market rally stalls, US and EU negative, JP up slightly. Earnings deterioration continues. Key data next week with US CPI and PPI.

Major market events 13th February – 17th February 2023

Highlights for the week

Mon: CH CPI, JP GDP (4Q22).

Tue: CH PPI, EU GDP (4Q22), US CPI.

Wed: UK CPI, UK PPI, US Retail Sales, US Industrial Production & Capacity Utilization.

Thur: US Philadelphia Fed Manufacturing, Index, US PPI, US Jobless Claims.

Fri: UK Retail Sales, German PPI, French CPI.

Performance Review

And then the rally stopped – the writing was on the wall. The surprise Non-Farm Payroll caused everything in the market to be repriced, with the terminal rate now above 5% and with Governor Powell saying that the Fed will have to hike more than what the market is currently expecting if the job market continues to be strong. Earnings once again were disappointing, and the erosion is continuing, which is worrying. My feeling is that will continue to be the pattern for a while, at the very least until we have reached the peak in rates. On the economy, we have differing outlooks on both sides of the pond: on the US side, Goldman Sachs has cut the likelihood of the economy getting into recession from 35% to 25% but went on saying that could mean that the Fed will hike more than forecasted; on the European side, the UK very narrowly avoided a recession in 4Q22 (0% growth) and future growth perspectives don’t seem very appealing. While there are calls on both sides of the Atlantic for Central Banks to cut rates in 2023 to support the economy, we haven’t reached the peak in rates yet, so these seem at the very least premature. Japan was the only market to end the week in the black, and discussions on who is going the next BOJ Governor continue, as Kuroda’s term will end in April. We have another busy week with Europe’s 4Q22 GDP, US CPI and PPI, and UK CPI, all of which will be very helpful in helping to form an outlook.

Checking up on the economy: the good

Source: Goldman Sachs, Wall Street Journal

Goldman Sachs not only is more optimistic than the consensus on prospects for US GDP growth in 2023 but has cut the probability of the economy going into a recession from 35% to 25%, warning however that a better economy might warrant higher rates. To be sure, Goldman’s forecast expects 2 more 25bp hikes to reach a target of 5-5.25%, which is in line with what is currently priced by the market after the Non-Farm Payroll.

Source: The Daily Shot

Recall that the Fed’s dilemma lies between falling inflation on one side, and the strong job market on the other, so that’s why this week’s CPI and PPI can tilt the pendulum one way or the other. Another positive factor is the receding rates volatility, given that the target for peak rates is in sight.

Source: BofA Global Investment Strategy, Bloomberg

And while EPS growth has been declining, it remains steady above the long-term growth trend.

Source: Real Investment Advice

Finally, openings in the job market might be declining as well, removing one of the Fed’s primary areas of concern.

Source: BLS, UBS Evidence Lab

Checking up on the economy: the bad

Conditions have completely changed after Friday’s Non-Farm Payroll, and expectations for rate cuts have fallen in synch, as shown by the below chart, resulting in higher rates across the board. While a minimal cut is forecasted to take place in 2H23, the bulk of the reduction will happen in 2024.

Source: BofA Global Investment Strategy, Bloomberg, Fed funds futures

A consequence of that has been tighter lending standards, which usually precede recessions. The big question at this point is whether we have reached the peak or whether lending standards are likely to be tightened meaningfully further.

Source: BofA Global Investment Strategy, Bloomberg, Federal Reserve

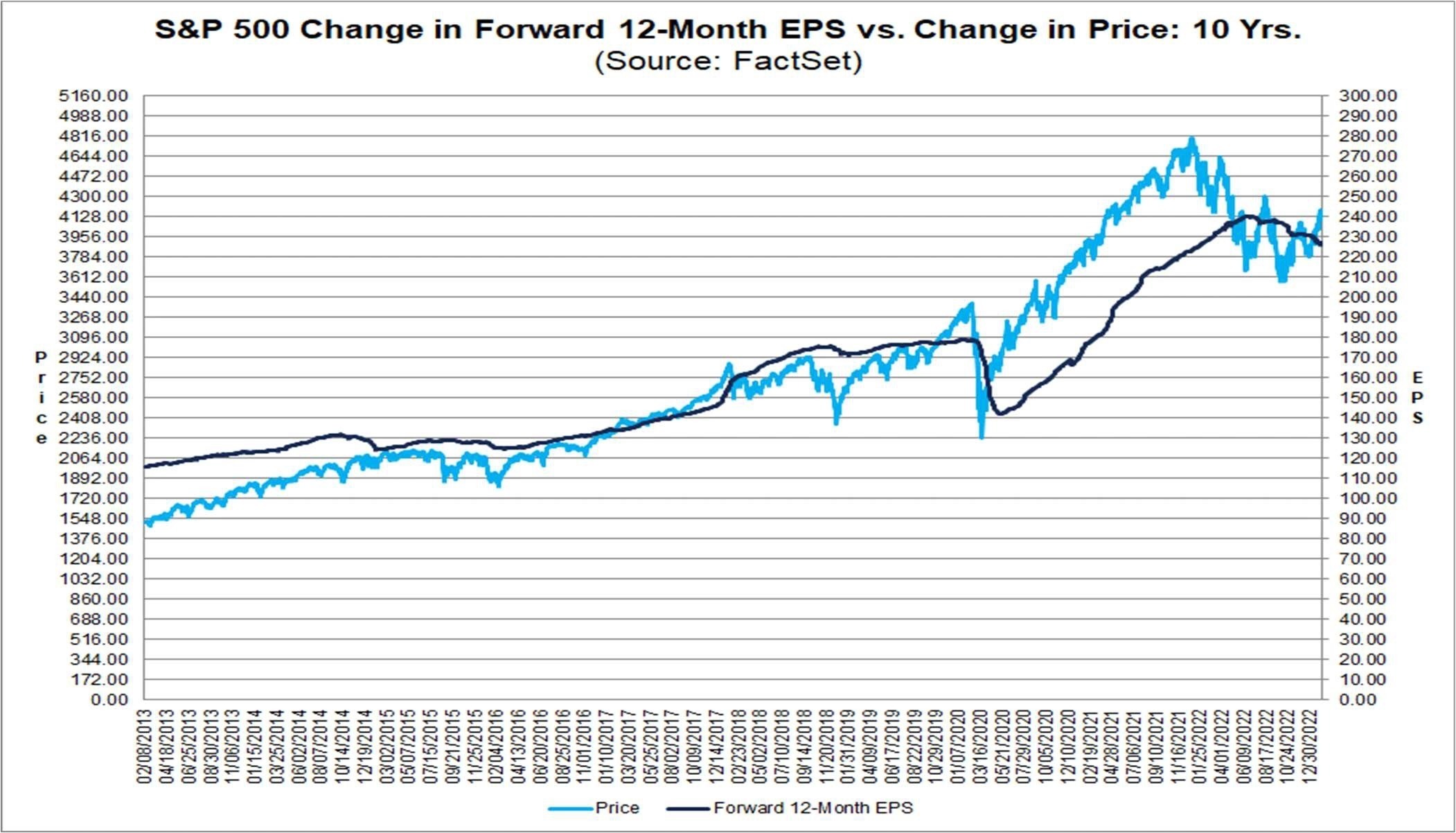

One of the biggest problems is deteriorating EPS Growth, and indeed 4Q22 will be the first quarter to have negative growth since the pandemic (3Q20). Given that at the moment most economic forecasters are split into whether the economy is going into a recession or not, watching EPS can be an important indicator. Recall that even in Goldman Sachs’ more constructive outlook about the US GDP in 2023, the bottom of the growth is happening in 1Q23. As the reports continue to be released, it will be important to watch whether the erosion has found a bottom. So far it hasn’t, and by now we have reached the level Goldman Sachs is forecasting for 2023 – $224, or zero growth from 2022.

Source: FactSet, Morgan Stanley Research

According to Morgan Stanley’s Leading Earnings Indicator, the fall in earnings is just about halfway, and more is to come. They have a forecast of $195 for 2023, which is about 13% below consensus. This is definitely one of the more bearish views on Wall Street.

Source: Morgan Stanley Research

And the result is these rather bearish targets, which are based for year-end 2023 on 2024 estimates. The current consensus for 2024 EPS is $249.5, so Morgan Stanley’s base case is 3.5% below consensus. According to them clearly growth should fall off a cliff in the earlier part of the current year; currently there is a slow and steady deterioration, but so far nothing that could bring such a colossal collapse.

Source: Bloomberg, Morgan Stanley Research

Checking up on the economy: the ugly

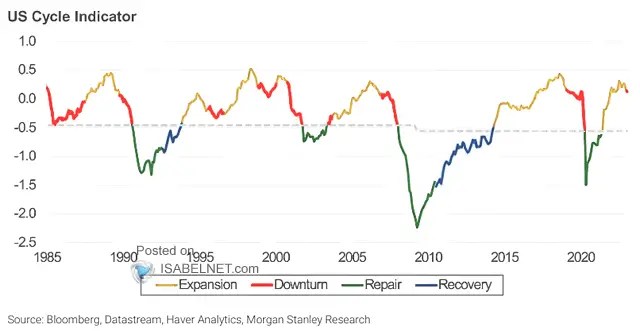

Morgan Stanley’s US Cycle Indicator is flashing red, and forecasting the beginning of a downturn.

Source: Bloomberg, Datastream, Haver Analytics, Morgan Stanley Research

This is unfortunately coupled with a meaningful deterioration of EPS. It is worth reminding again that Morgan Stanley has a bearish outlook, so this has to be somehow expected given their views.

Source: FactSet, Morgan Stanley Research

In fact, and I have been saying it for a while, the negative revision is palpable even taking into consideration the start of the year as a reference. So far it has been relentless.

Tighter lending standards are leading to lower corporate profits. Most companies, particularly in the Information Technology space, seem bent to save money rather than invest, given the uncertain outlook, but this is definitely another headwind for the economy.

Source: The Daily Shot

If we look at a longer time horizon, we will find that forward EPS growth has been negative only 5 times since 2000; were that to continue, the downside would certainly be ahead of us, as shown in the chart below.

Source: FactSet, Morgan Stanley Research

On top of that, the market has been hit by a meaningful deterioration in liquidity.

Source: BofA Global Investment Strategy, Bloomberg, Federal Reserve

Finally, according to the chart below, the S&P 500 bottomed 7 months after CPI inflation peaked. Given that the outlook is improving, but we are not quite there, this would signal a bottom some time in 2H23.

Sentiment and what the market is telling us

Morgan Stanley Market Sentiment Indicator has turned risk-off – watch out!

Source: Bloomberg, Datastream, Morgan Stanley Research

We also have to take into account that, seasonally, the back half of February is a difficult time for US Stocks.

Source: Carson Investment Research, FactSet

Other indicators paint a more mixed picture, to be honest. While Fear and Greed is in Greed territory, it managed to exit the Extreme Greed where it was last week (the market’s decline certainly helped to that end).

Source: ISABELNET.com

The AAII Indicator (perhaps a lagging indicator?) has some surprises for us this week. Bullish sentiment is above its historical average for the first time in 58 weeks. Neutral sentiment is still steady, while bearish sentiment is below average only for the 4th time in the last 64 weeks.

Source: AAII Sentiment Survey

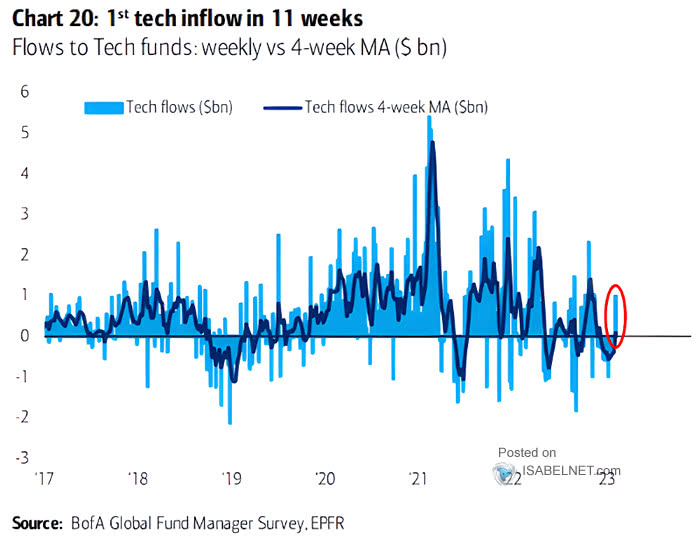

What are the Flows telling us?

Source: BofA Global Fund Manager Survey, EPFR

We have been speaking of Emerging Markets flows for a while, and most of these were positive, possibly signaling three things: i) confidence in the US Economy; ii) that the peak in US rates was in sight and on target, and iii) that a possible further depreciation of the US Dollar was likely. Now it seems these have rolled over after the latest Non-Farm Payroll, possibly putting the three above assumptions into question or at least believing these will materialize later than expected.

Source: BofA Global Fund Manager Survey, EPFR

And surprise surprise: tech is back in fashion? According to the above chart, it would seem at least it is being considered by fund managers once again. Certainly, this year’s performance has been meaningful and it helped re-establish leadership for the sector and for the broader Nasdaq 100 index. Will it last?

Earnings Review

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 18.0x, down from 18.4x last week, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings eventually broke the $ 230 mark as roughly 70% of US Corporates have reported for 4Q22. Still, the next two weeks will bring meaningful revisions as the rest of the reporting for 4Q22 unfolds. There we will probably understand how the economy is shaping up for 1Q23 and beyond, even though looking at the guidance provided so far, the outlook does not seem to be pretty.

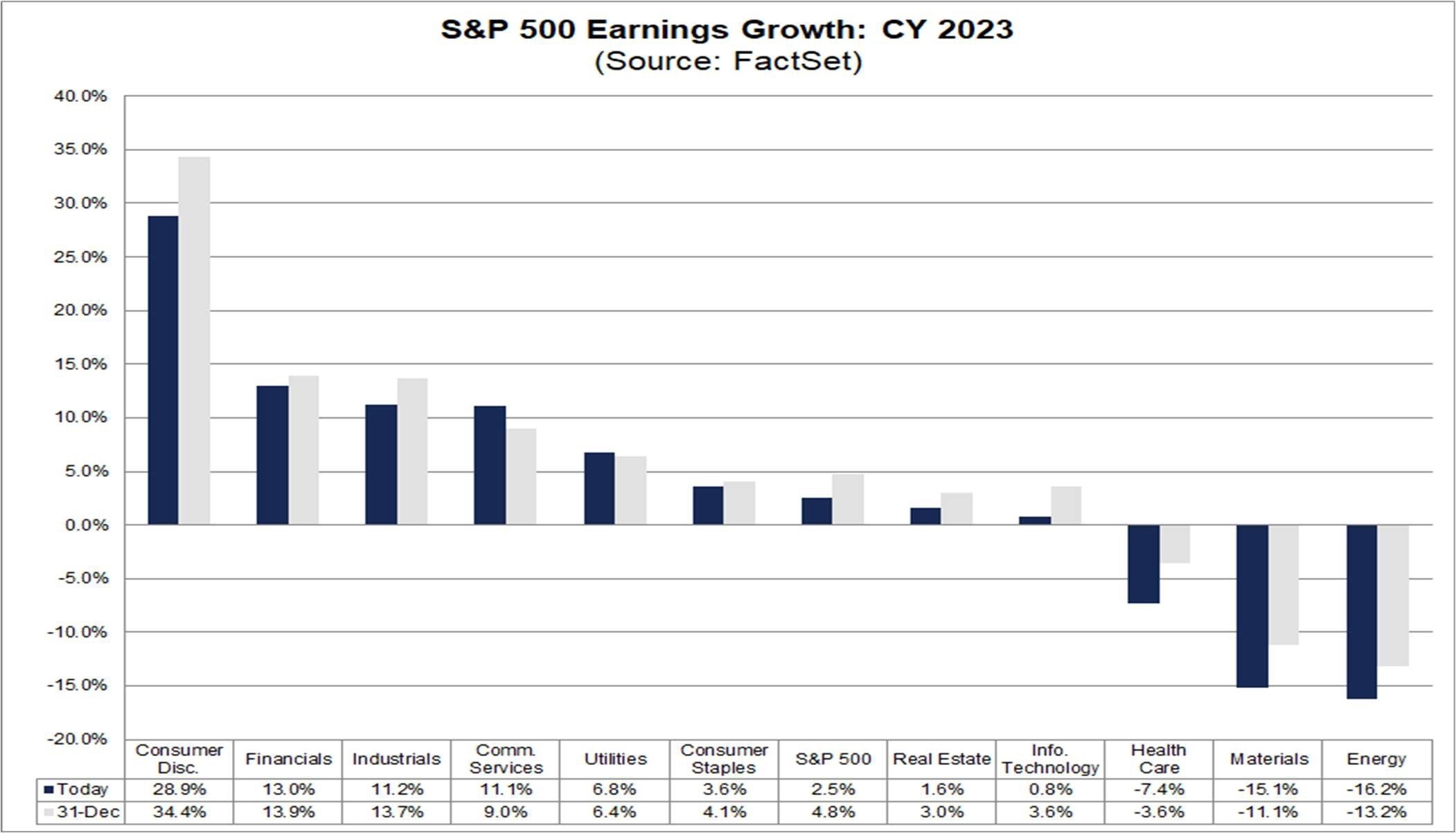

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -4.9% – revised upwards from -5.3% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 2.5% year on year, again revised downwards from 3.0% last week.

Source: Factset

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Utilities and – perhaps surprisingly – Communication Services; all the others are facing cuts. After a few disappointing earnings reports Technology has seen its earnings estimates reduced to a mere 0.8% from 3.6% a little more than a month ago.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.4% from 2.5% one week ago. Financials are leading the pack in terms of revenue forecasts, and are one of a few sectors (together with Consumer Staples) to have a higher or equal revenue forecast relative to the end of 2022, with all other sectors being down. Information Technology revenue growth has been cut to 2.0% from 3.7% one month ago – less than earnings.

Source: Factset

Introducing EPS for 2023 and 2024, which not surprisingly took a downward revision recently. The forecast for 2023 – which has held steady since mid-November when the first figures ($ 229) were published – has now been updated to $224; while 2024 has had a cut of the same measure from $ 254 to $ 249.56 I look with much interest at further revisions as the 4Q22 report season gets underway.

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than is about earnings at this point, the latter’s deterioration is continuing to get me worried as the downward revisions have been relentless and guidance very muted. I will be looking at next week’s report with much interest.

Earnings, What’s Next?

The earnings season is now entering in full swing its 4Q22 reports. Highlights this week include Coca-Cola (Tuesday, Before Open), Marriott (Tuesday, Before Open), Kraft Heinz (Wednesday, Before Open), Cisco Systems (Wednesday, After Close), and John Deere (Friday, Before Open).

Source: Earnings Whispers

Market Considerations

While we continue to debate whether the US economy will fall into a recession or not (but even if there was one, it does look to be mild, as revenue growth forecasts for 2024 are healthy and have been revised upwards from December 31), we should focus – as I have for some time – on the relative value of Treasuries vs US Equities. As long as EPS revisions (for 2023) continue to be downward, I stick to my preference for bonds over equities. We have evidence that the market bottoms 7 months after the CPI has bottomed and – while we are late in the game – there is quite some time to go (my gut feeling – bottom of the 7th). As we move on to more data (CPI and PPI) and more earnings in order to get more pieces of information, I’d stay neutral at this point, although brave investors might want to go on a tactical long before the CPI and PPI to take advantage of these readings – with 2% stops (measured on the S&P 500). For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx 3.5-4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a valid compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling. 10-Year yields were turbulent last week, particularly in Europe. Continue to prefer the US over Europe and Japan, even though the dollar deterioration can be a source of concern.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply