Central Banks hike as advised; equity markets continue to make progress, led by an unstoppable Nasdaq. A very strong jobs market puts the brakes on the market rally.

Major market events 6th February – 10th February 2023

Highlights for the week

Mon: German CPI and EZ retail sales.

Tue: US consumer credit and German industrial output.

Thur: Riskabank rate decision.

Fri: US Michigan Sentiment and UK GDP.

Performance Review

The crucial week certainly did live up to its hype and did not disappoint. Central banks hiked as expected (the Fed by 25bp, the ECB and the BOE by 50bp), and we had a very positive earnings report from Meta on Wednesday, but on Thursday all major tech bellwethers disappointed (Apple, Amazon, and Alphabet) signaling some fatigue in meeting previous targets and Wall Street Estimates. Then just as I thought we had the rates’ peak in sight, Friday’s Non-Farm Payroll (way ahead of the forecast) and unemployment rate (below the forecast at 3.4%) threw a spanner in the works. Governor Powell did say that there there is going to be a new forecast in March, possibly signaling one more 25bp hike, and then we will see. Still, he’s not going to be happy with the overheating of the job market which means that policy might have to be reviewed, and in that respect, the next two months of data are going to be crucial. It is curious to note that the market didn’t quite succumb to the double whammy of negative earnings and negative data, as at one time on Friday was almost unchanged, before closing down as expected. It is very curious to note that some indicators are inconclusive at this point – such as the future rates curve not moving much following the reports. I shall look at quite a few of them below but as they paint a mixed picture (some are good and some are not) I believe caution is needed to navigate the muddy waters at this point. So let’s have a look!

Checking up on the economy: recession or no recession

Source: Goldman Sachs

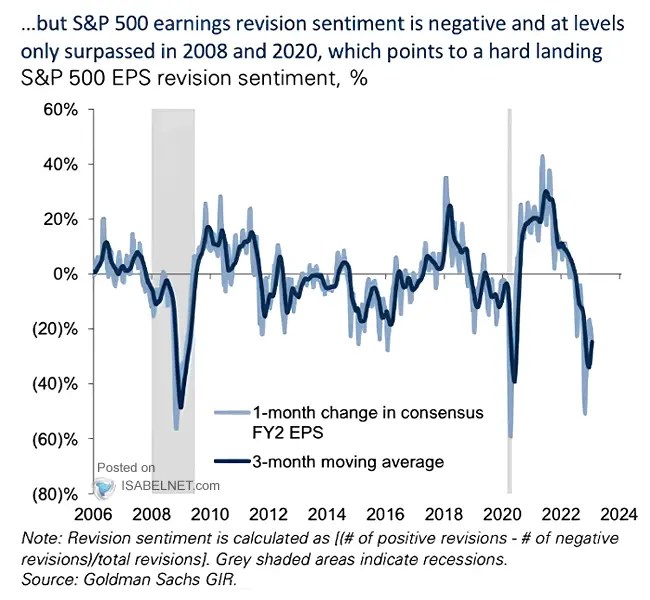

Goldman Sachs is more optimistic than the consensus on prospects for US GDP growth in 2023. The most challenging quarter is the first quarter, but then the economy is forecasted to pick up some steam in 2023. This certainly tends to rhyme more with the strength of the jobs market, which has been surprising, and less so with the almost constant cutting of earnings, which has been relentless (albeit still showing positive growth for both revenue and EPS growth in 2023). This is somehow tempered by the negative earnings revision, which seems to point to a hard landing, and which is somehow giving an opposite view to the positive GDP growth stance.

Source: Goldman Sachs GIR

It is then useful to look at how Goldman translates this into a tradable scenario below:

Source: FactSet, Goldman Sachs GIR

The forecasted value for US Earnings in 2023, $ 224 per share, on a zero growth from 2022, almost matches the current consensus estimate of $ 225, which has been cut from a value of $ 229 since this forecast was launched late last year. The S&P 2023 target of 4,000 sounds ominous as it would mean a sizeable descent from current levels, all this in a soft landing (hence positive) scenario. I would guess that the market is paying more attention to rates at the moment than earnings, even though as expected, Meta was rewarded (handsomely one may say) for its efforts, while Apple, Amazon, and Alphabet were all punished to varying degrees. The biggest question is that the jobs outlook threatens the whole rates scenario, so this is something I will be paying a lot of attention to as we go on. Of course, earnings are very important too, but so far they have given a univocal signal of retreat.

The dilemma of the Federal Reserve

The latest presser by J. Powell portrayed a slightly different economic landscape from the one the FED has been rendering up until now. For me the main takeaway of the J-POW speech and Q&A was that inflation can get back to target without the economy going through a contraction. Maybe even without significant job losses. But before jumping the gun and rushing to conclusions, let’s analyze what is big dilemma the FED is now facing.

The December FOMC median forecast sees a top for the current hiking cycle between 5-5.25%, and we now know that the forecast will be updated in March. On paper, everything (but the job market) points as if the Fed has done its job as inflation is falling across the board. The market has been trying to anticipate that and doesn’t even see the Fed Funds topping 5%. Indeed, there are expectations for a rate cut as the year goes by.

Source: Federal Reserve, Nomura

The chart below shows how little the curve has changed, and if it has, it is pointing to greater cuts rather than higher hikes. This will have to be monitored closely in light of the exceptional December Non-Farm Payroll (which might well include a component of seasonality) and of the further, unexpected reduction in the unemployment rate.

Source: The Daily Shot

Source: The Daily Shot

The recent job openings have been very strong and this chart shows that there are almost two job openings for each unemployed citizen. This worries the Fed, as solid spending by the consumer might indeed fan inflation.

In addition, the total nonfarm quit rate, reported by the BLS, shows signs of resilience with an uptick over the last two months.

Source: U.S. Bureau of Labor Statistics

Even for those reluctant to fully trust the reliability of the jobs opening survey, two clues begin to make a proof. The job market remains tight!

Earnings, however, are telling the opposite tale: that the consumer has been careful about spending no matter what. In fact, Inflation has been falling for quite a while, even in spite of strength in the jobs market.

Source: The Daily Shot

The above chart shows how much earnings have been under pressure. Negative earnings revision was constant in 2H22 – in synch with the Fed’s own hike plans – and is something that hasn’t quite stopped. When we look at 4Q22 the picture isn’t that bad, despite the negative growth; it’s for 1Q23 that companies have been most cautious, particularly when issuing guidance (with the notable exception of Meta).

Source: BofA Global Investment Strategy, Bloomberg

We cannot forget the recent job cuts, particularly in technology, about which I have written recently. Were this to persist, it is quite possible that it may drag the economy into a recession. This is somehow in contrast with the chart above, which shows plenty of opportunities available. While tech workers which have been laid off are likely to find employment soon, the recent softness in real estate in the broader San Francisco area does not bode well for the future.

Source: FactSet, Morgan Stanley Research

And finally one of my favorite charts shows how the Fed should be cutting – not hiking rates – when EPS growth is faltering. The problem is that the US Central Bank’s mandate is to keep inflation in check, and Governor Powell has shown he is not afraid of spooking the market (if needs be) in order to reach that goal. Still, I think inflation will fall further before the economy will go into recession; the Fed might well – as a consequence of the tight job market – hike more than forecasted, but that shouldn’t prevent inflation from being tamed over the coming months.

Sentiment and what the market is telling us

Source: Carson Investment Research, FactSet

Following meaningful gains in January and with yet another positive week behind us, it is somewhat reassuring to note that the outlook for the rest of the year is a positive one. According to the data, the outcome would be even more positive if the strong performance will continue in February. Were that to materialize, historically we could count on an increase in performance for the rest of the year as a given.

Source: Real Investment Advice

This is echoed by the chart above, which shows the number of stocks with bullish buy signals has recently increased beyond 80%. With EPS declining, as we will see below, this has impacted the average multiple as a result. Were the market to look at earnings as depressed and calling a bottom due to the bulk of the hikes being behind us, then one could maintain a bullish stance beyond what we can see at the moment, but that is definitely a risky move. For now, I will simply acknowledge a market that is robust and does not want to go down, led by a seemingly unstoppable Nasdaq. Last year’s zeros have turned into this year’s heroes.

Source: BofA Global Investment Strategy, EPFR Global, FMS, CFTC, MSCI

According to this proprietary indicator from Bank of America, there is still space before we get to extreme bullishness. I would tend to agree especially if we looked at the broader picture (one year). Other indicators, perhaps more relevant in the near term, are not so sanguine, as the charts below show:

Source: ISABELNET.com

Source: AAII Sentiment Survey

The weekly fear and greed indicator is now showing extreme greed and, once again, has meaningfully climbed from just last week. While in the AAII Indicator the bearish sentiment has subdued somewhat, it is still higher than its historical average. What is striking at the moment is the prevalence of the neutral sentiment, as if the market would just prefer to wait and see what’s happening – as I do.

Source: The Daily Shot, Goldman Sachs

Source: BofA Securities

Finally, there are a couple more things worth noting. As we can see from the first chart, expectations for a falling US dollar are leading to prefer companies that do a meaningful part of their business abroad, versus at home. It’s strange in a way because economies abroad were never as strong as the US economy was and is. US corporate buybacks remain strong, signaling that a meaningful part of them are happy to buy their own stock with the current growth perspectives and valuation. That, I think, has also been a major component of the market’s 2023 unexpected resilience.

What are the Flows telling us?

Source: BofA Global Investment Strategy, EPFR

Last week we spoke of Europe, this week we are drawing our attention once more to flows to the Emerging Markets. It is clear in my mind that these cannot continue unless you are banking on a positive US rates outlook. The next few weeks will shed more light with more economic data – including the ever-so-important CPI and PPI – and with more indications as to how corporate America is coping with the current conditions as the earnings roll out.

Earnings Review

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 18.4x, up from 17.8x last week, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings eventually broke the $ 230 mark as roughly 50% of US Corporates have reported for 4Q22. Still, the next two weeks will bring meaningful revisions as the rest of the reporting for 4Q22 unfolds. There we will probably understand how the economy is shaping up for 1Q23 and beyond.

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -5.3% – revised downwards from -5.0% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 3.0% year on year, again revised downwards from 3.4% last week.

Source: Factset

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Consumer Staples; all the others are facing cuts. After a few disappointing earnings reports Technology has seen its earnings estimates reduced to a mere 1% from 3.6% little more than a month ago.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.5% from 2.6% one week ago. Financials are leading the pack in terms of revenue forecasts, and are one of a few sectors (together with Real Estate and Consumer Staples) to have a higher or equal revenue forecast relative to the end of 2022, with all other sectors being down. Information Technology revenue growth has been cut to 2.3% from 3.7% one month ago – less than earnings.

Source: Factset

Introducing EPS for 2023 and 2024, which surprisingly took a downward revision recently. The forecast for 2023 – which has held steady since mid-November when the first figures ($ 229) were published – has now been updated to $225; while 2024 has had a cut of the same measure from $ 254 to $ 250.04. I look with much interest at further revisions as the 4Q22 report season gets underway.

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than is about earnings at this point, the latter’s deterioration is continuing to get me worried, particularly as the market continues to I will be looking at next week’s report with much interest.

Earnings, What’s Next?

The earnings season is now entering in full swing its 4Q22 reports. Highlights this week include Uber (Wednesday, Before Open), Walt Disney (Wednesday, After Close), PepsiCo (Thursday, Before Open), Kellogg’s (Thursday, Before Open), and Paypal (Thursday, After Close).

Source: Earnings Whispers

Market Considerations

Well, the Fed overhang isn’t quite gone, unfortunately, as Friday’s Non-Farm Payroll puts everything into question. That wasn’t enough to stop the S&P 500 from having another positive week, driven by a seemingly unstoppable Nasdaq despite earnings that were not quite up to standard. We move on to more data (CPI and PPI) and more earnings in order to get more pieces of information. I’d probably take some profits at current levels – maybe 50% of your position – and stay long with the remaining part with 2% stops (measured on the S&P 500). Finally the 10-Year yield came down last week, particularly in Europe after the ECB. Continue to prefer the US over Europe and Japan, even though the dollar deterioration can be a source of concern. The very impressive rally in equities has somehow changed my previous preference for bonds, but I still think that long (US) bonds is probably the easier trade here with less volatility, while for those who can stomach higher volatility and a longer investment timeframe it might make sense to test waters in equities as advised. For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx 3.5-4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a valid compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply