Equity markets are on a roll; Nasdaq in double digits returns for the year despite inconsistent earnings. Next week will be crucial with so much key data.

Major market events 30th January – 3rd February 2023

Highlights for the week

Mon: Germany / Sweden Flash GDP 4Q. South Korea Industrial Output.

Tue: Germany / France CPI, EZ GDP Flash 4Q, US Case Shiller.

Wed: US ADP Employment, FED Monetary Policy. China Caixin Manufacturing PMI.

Thur: ECB / BOE Monetary Policy Meeting.

Fri: US Non-Farm Payroll. China Caixin Services PMI.

To Watch: Blockbuster week with the FOMC and the ECB/BOE on the other side of the Atlantic. A slew of heavyweight earnings reports.

Central Banks are on the run…

Next week is going to be crucial to either confirm the upwards direction of the market or to bill it as a poor-quality rally. There are three central banks’ decisions (Federal Reserve, European Central Bank, and Bank of England); and key data releases in the US (ISM, non-farm payrolls, and the employment cost index) and in Europe (inflation, GDP, and confidence data). If that wasn’t enough, the reporting season continues with tech bellwethers reporting on Thursday, After Close. Fasten your seat belts, please!

Source: Bloomberg Finance L.P. and Wells Fargo Economics

While the discussion about a potential recession continues, I’d like to take a look at this spotlight of what the world’s major central banks are doing.

Risks to Growth & Inflation

While the recent GDP data was above estimates at 2.9% vs 2.6%, the discussion has veered on whether the Fed should react to this data with a 25bp or a 50bp hike. Inflation is still elevated, although trending down. I think 25bp is a done deal, and this would possibly leave one more hike on the cards for Governor Jay Powell and his team. The situation is even more delicate for the ECB, which never hiked as much as the Fed did. Stuck at 2%, they have no choice but to hike by 50bp, but what’s more important is the terminal rate which might well be 3% or slightly above that level – a surprise given their recent hawkish statements. Similarly for the BoE, the hike will be 50bp to 4% – but there are already calls for the central bank to ease within 2023 (!) in order to help the economy. Recession or no recession, it seems to me that the peak in rates is within sight.

Performance Review

Markets are on a tear once more, despite mixed economic data and mixed earnings. Strong performance across the board in all regions, with growth stocks and the Nasdaq clearly trumping everything else. Earnings were mixed and the companies that did not perform well were punished (Intel, IBM), while more solid reports from Tesla and Microsoft guided the market higher. This happened despite yields trickling higher in all regions, particularly in Europe. Next week is going to be crucial to either confirm the upwards direction of the market or to bill it as a poor-quality rally. There are three central banks’ decisions (Federal Reserve, European Central Bank, and Bank of England); and key data releases in the US (ISM, non-farm payrolls, and the employment cost index) and in Europe (inflation, GDP, and confidence data). If that wasn’t enough, the reporting season continues with tech bellwethers reporting on Thursday After Close. Fasten your seat belts, please!

Source: BofA Global Investment Strategy, Bloomberg, ICI Investment Company Institute

The Relative Value Bonds / Equity

The strong preference for cash should come as no surprise, given the current yields in the US and in many other parts of the world, including Europe. I have been advocating to switch from equities to bonds for prudent investors as there are attractive yields between 3-4% in most geographies (US, UK, Italy). I have derived this from the world’s sovereign wealth funds which have a nominal return policy, over time, of 4% a year. That said, this is not a normal year by any standard. I’m starting to think that the market in the disaster that was 2022 might have already incorporated the recession or soft landing in prices, and now it is looking at (with a forward perspective of 6-12 months) an economy on the rebound with rates falling, or definitely not going much higher than present levels. Some of the data coming next week will be crucial to assess this possible scenario.

Source: Goldman Sachs Global Investment Research

Steady as she goes. Before delving into market and sentiment considerations, I’d like to introduce this chart from Goldman Sachs about a future projection in GDP growth for the world’s biggest economies. The US leadership could be toppled by China in a space of just 10-15 years (much earlier than 2050 when the first concept of BRIC was floated) and also highlights the enormous potential of India, as the Asian nation is poised to become the world’s most populous country. Japan, on the other hand, seems to be stuck in its low growth pattern, which will still take considerable time to reach the peak of its economy in the 1990s. While this is showing what the future will likely look like, at the moment it is still prudent to treat China and India as Emerging Markets from a risk/return perspective. Hence, buy America(n)!

Market Sentiment flashing “GREED”

Source: Morgan Stanley

Source: ISABELNET.com

Source: AAII Sentiment Survey

Back to the markets with the Morgan Stanley Global Risk Demand Index in greed territory. The weekly fear and greed indicator is also showing greed and has meaningfully climbed from just last week. The bounce for equities has been strong since the beginning of the year, and as a much-esteemed colleague tells me, everyone is skeptical yet the market continues to climb. I guess with this week we might have arrived at a first showdown in terms of inflation, rates, and earnings, even though on the latter we have still a long way to go. If the market turns, it could get ugly in a few sessions. I also note that bearish sentiment has retreated, while still being above average.

Source: Goldman Sachs

We are just 25% into the current earnings report, so there is time for things to change, but the chart above shows us that bad earnings do not seem to matter that much. Clearly, stocks are punished on the day, but that could turn out to be a buying opportunity at least until the market continues to have its current positive posture. At the moment, the S&P 500 is showing great resilience.

Source: Goldman Sachs

What are the Flows telling us?

Source: BofA Global Investment Strategy, EPFR

Source: BofA Global Fund Manager Survey

Source: BofA Global Investment Strategy, EPFR

Europe revival? These two charts testify to increased attention on Europe from investors. European markets have lower valuations on their side, but a possible headwind in the ECB and yields. Moreover, they have been characterized by a significant rotation, and the leading names must find their luster again for the market to prop higher. Still, it is being chased by the US, which made up some of the lost ground last week.

Earnings Review

Source: Trueup.io/layoffs

Not all is well in tech at the moment, despite the impressive performance of the Nasdaq. There have been massive layoffs across the board by virtually all big-tech names and earnings have been inconsistent in that they have shown a slowdown despite bright spots in particular niches (Microsoft Azure). The first chart above highlights the short covering that has taken place in tech – given last year’s performance and this year’s bounce that had to be expected somehow. The capitulation shown by many tech investors in the second chart could actually be a bullish sign – as expectations have been reset and the decks have been cleared. It will be particularly interesting to watch Apple’s report on Thursday as rumors of limited demand for mobile phones have been swirling all around.

Source: FactSet, BofA US Equity & Quant Strategy

Margin expectations have been cut as consumers are feeling the pinch from higher rates and companies can no longer pass on all increased costs. However, these are still healthy and are expected to be at record levels in 2023. What worries me is that estimates for earnings and revenue growth are being cut from one week to the next – but even with the reduction, margins still seem to be ok at the moment.

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 17.8x, up from 17.0x last week, which is below the 5-year average at 18.5x but above the 10-year average at 17.2x. Earnings seem to hover around the $ 230 mark lately, but it is clear that the next two weeks will bring meaningful revisions as 4Q22 unfolds. There we will probably understand how the economy is shaping up for 1Q23 and beyond.

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -5.0% – revised downwards from -4.6% a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 3.4% year on year, again revised downwards from 4.2% last week.

Source: Factset

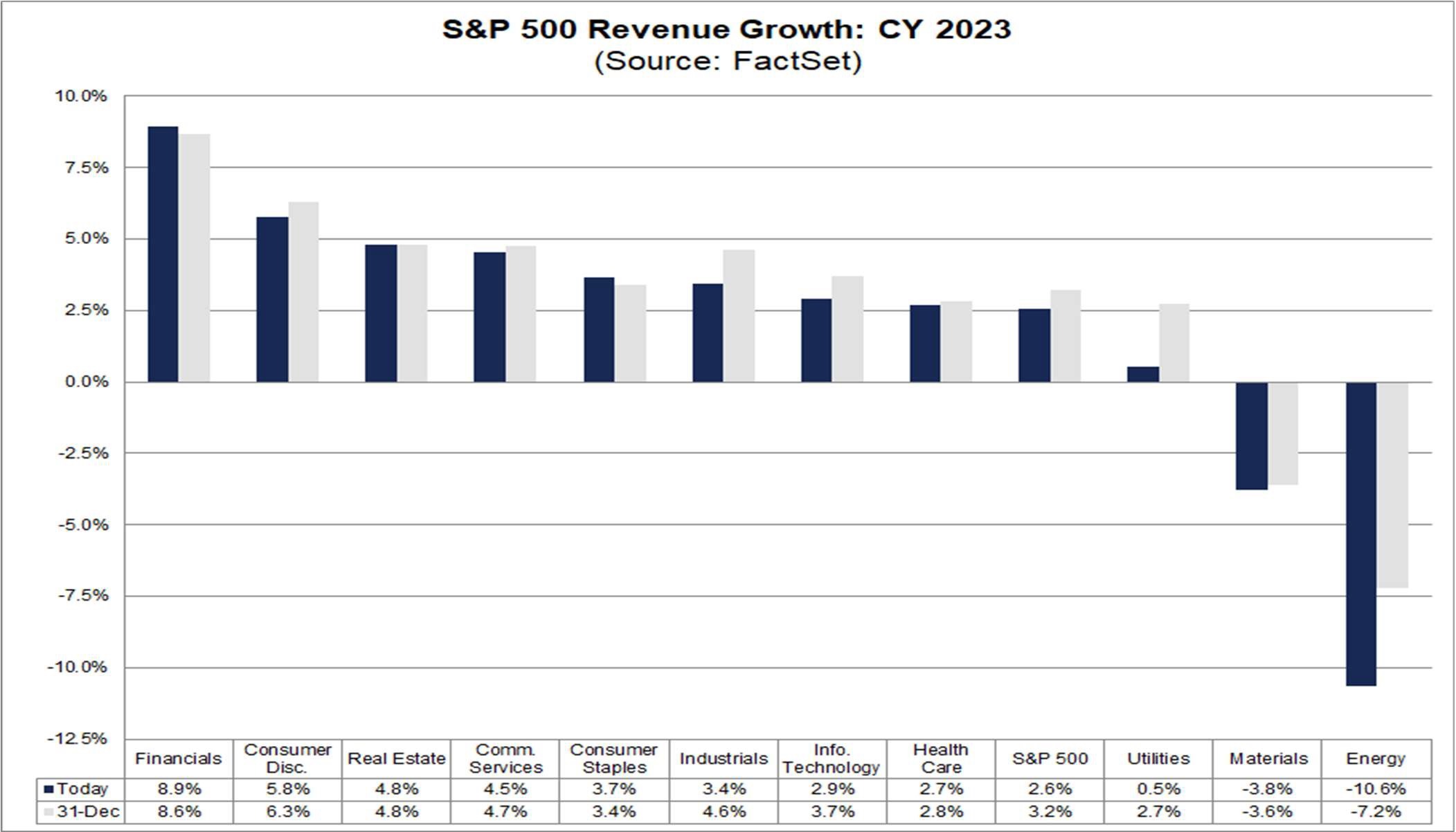

Very few sectors are holding up estimates relative to 31 December. The only sector not to have its estimates cut further is Consumer Staples; all the others are facing cuts. After some earnings reports, After a few earnings reports Technology has seen its earnings estimates almost halved since one month ago, to 2.0% from 3.7%.

Source: Factset

The S&P 500 has its revenue growth estimates trimmed further to 2.6% from 2.9% one week ago. Financials are leading the pack in terms of revenue forecasts, and are the only sector to have a higher revenue forecast relative to the end of 2022, with all other sectors being down. Information Technology revenue growth has been cut to 2.9% from 3.7% one month ago – less than earnings.

Source: Factset

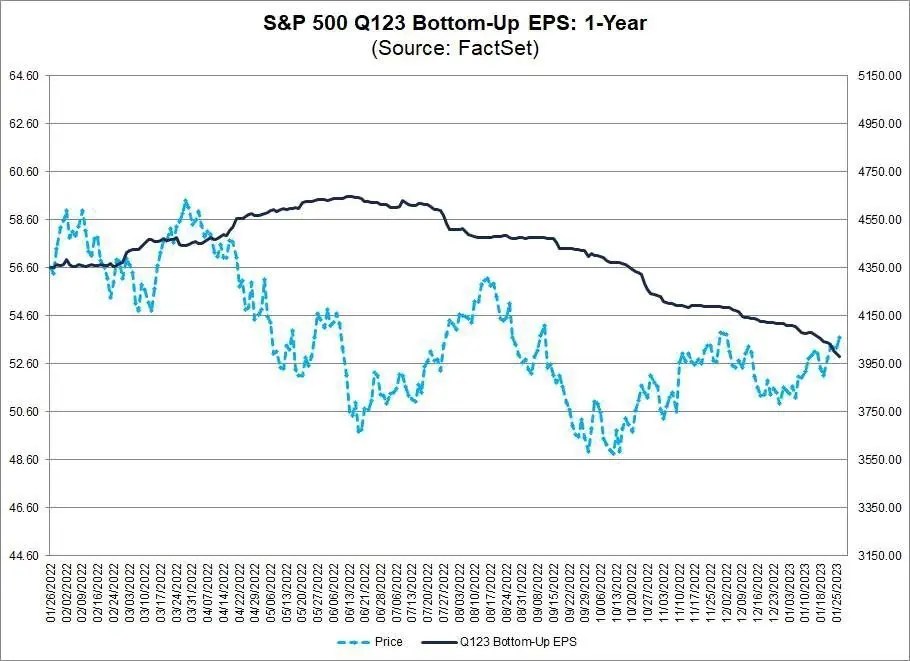

Introducing EPS for 2023 and 2024, which surprisingly took a downward revision recently. The forecast for 2023 – which has held steady since mid-November when the first figures ($ 229) were published – has now been updated to $226.1; while 2024 has had a cut of the same measure from $ 254 to $ 250.18. I look with much interest at further revisions as the 4Q22 report season gets underway.

Source: Factset

This is the detail for 1Q23. While the market might be more concerned about rates and recession than is about earnings at this point, the latter’s deterioration is continuing to get me worried. I will be looking at next week’s report with much interest.

Earnings, What’s Next?

The earnings season is now entering in full swing its 4Q22 reports. Highlights this week include McDonald’s (Tuesday, Before Open), Meta (Wednesday, After Close), Honeywell (Thursday, Before Open), Amazon (Thursday, After Close), Apple (Thursday, After Close), and Alphabet (Thursday, After Close).

Source: Earnings Whispers

Market Considerations

Source: JPMorgan

The chart above shows that for many markets investors have been reducing underweight; that is particularly true for US Equities. While this is not a market for the fearful, the S&P 500 followed last week’s retaking 50 and 200 DMA making further strides. The Nasdaq’s progression this year, while completely unexpected, is nothing short of impressive. I believe that the upcoming Fed meeting may problem to be an opportunity for the market to still grind higher – 25 or 50bp it might be (although my forecast is firmly on the former). With the Fed overhang gone, the recession theme being muted, and hopefully some decent reports in sight, there is the potential for markets to do better. So I’d advise to tactically step in before the Fed meeting albeit with a very tight stop (2% if possible). Will continue to watch closely the 10-Year yield after a meaningful climb last week, particularly in Europe. Continue to prefer the US over Europe and Japan, even though the latter can get some respite from the BOJ’s decision to enforce its current ceiling for JGBs. The very impressive rally in equities has somehow changed my previous preference for bonds, but I still think that long (US) bonds is probably the easier trade here with less volatility, while for those who can stomach higher volatility and a longer investment timeframe it might make sense to test waters in equities. For the less volatility prone of you, it may make sense to take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx 3.5-4%) yields.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply