A week on the sidelines for equities, rates, and bonds. US CPI and PPI both pointed to lower inflation going forward. The Fed might be done, but not the ECB or the BOE. S&P 500 ex-energy earnings might have troughed in 1Q23. Continue to be moderately positive on equities (but watch out for stops!) and neutral on bonds.

Major market events 15th May – 19th May 2023

Highlights for the week

Mon: JP PPI, CH PPI, EU Industrial Production, EU Economic Forecasts.

Tue: CN Industrial Production, EU GDP, US Retail Sales, US Industrial Production, US Capacity Utilization.

Wed: JP GDP, EU CPI.

Thu: JP Trade Balance, US Philly Fed Manufacturing Index, US Initial Jobless Claims.

Fri: DE PPI, Fed Chair Powell Speaks.

Performance Review

- A week on the sidelines for markets, despite positive (non-inflationary) data coming out of the US CPI and PPI. Early reports for 1Q23 were very positive, with 78% of S&P 500 companies reporting a positive earnings surprise, and 75% of S&P 500 companies reporting a positive revenue surprise.

- Once again it was Nasdaq’s turn to shine, followed by the Nikkei 225. Poor breadth and continued outperformance of the technology mega caps are continuing to be recurring themes.

- Technically we are still in limbo: the Nasdaq 100 is well clear of its previous top on Feb 2 (12,803.14), but the S&P 500 hasn’t managed to do that yet (4,179.76). On the positive side, if the S&P 500 manages to climb above its previous top, I can see an extension of the current rally; on the negative side, should the Nasdaq 100 fall below its previous top on Feb 2 then much more caution should be exercised (a chance of a double top and of the market re-testing recent lows). In addition, the Euro Stoxx 50 is approaching its previous peak set in July 2007 (4524.45) and a breakout above that level might signal another leg up for equities.

- The never-ending discussion on rates continues; after the Fed did hike by 25 bps in May as expected, questions abound on whether this is going to be the last increase and the top in rates. The benign CPI and PPI possibly point to some moderation, or a pause by the US Central Bank, with just one additional doubt about a final hike in June. There is growing consensus that the current level of rates is at a restrictive level for the economy, and therefore Governor Powell could continue to keep it at the same level for the rest of the year to further tame inflation. After having gone past the rates tantrum, the baton passes on to the economy, which so far has performed admirably, despite the tough environment. In 2H23 it is expected that the economy will meet a more benign rate environment. The decline in earnings in 1Q23, -2.5%, was way ahead of expectations of -7%: this could be their trough. It is important to see if bottom-up forecasts for both 2023 and 2024 continue to be cut or, at some point, manage to find their feet.

- 1Q23 earnings reports are drawing to an end, with 92% of S&P 500 companies having reported, although they will continue this week with some notable companies reporting, especially amid Chinese ADRs.

Checking up on the economy: the good

The ‘good’ points to more sustained growth and no recession, albeit at the cost of higher rates (the ‘higher for longer’ moniker that is soon becoming a mantra), even though expectations for rate cuts are mounting. There does seem to be a change in the narrative though, at least according to what is being priced by the market, with rates becoming less of a concern and the economy’s performance becoming more of a concern. Having a look at US’s nominal GDP we can see that the US Economy has performed admirably, climbing well above its pre-Covid highs. Interestingly, the performance in 1Q23 was much better than feared on all fronts; 10 sectors are reporting higher earnings, compared to Mar 31, due to positive earnings surprises.

Source: BofA Global Investment Strategy, Bloomberg

Speaking of inflation. there are signs that the sticky CPI less food and energy has peaked, while the flexible CPI less food and energy has come down considerably – adding to further expectations of an ongoing decline in the coming months.

Source: Federal Reserve Bank of Atlanta

Another positive sign comes from earnings. If we consider the S&P 500 ex-energy, there is increased evidence that they could have troughed in 1Q23 and that 2Q23 should represent the bottom for the entire market. Given current valuations, almost priced for perfection, an expansion in earnings would be certainly seen very positively by the market.

Source: FactSet, Goldman Sachs Global Investment Research

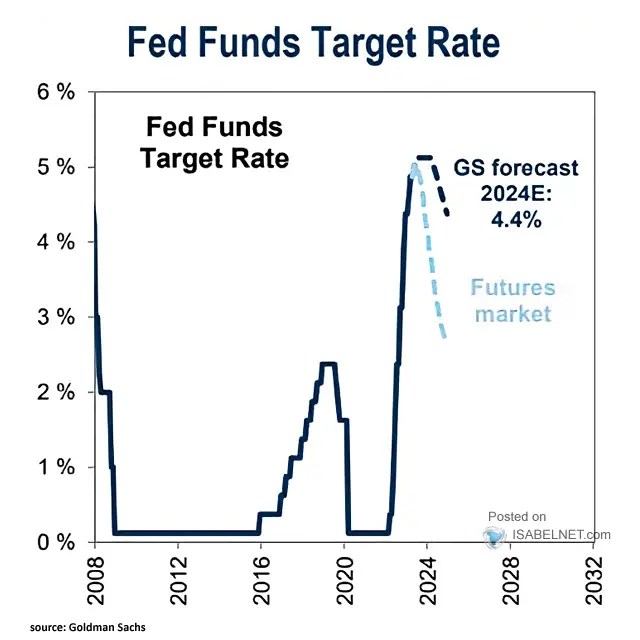

Finally, I have spoken of the more benign rate environment facing the economy in 2H23. The chart below shows that, on average, there were 4 months from the last hike to the first cut. In fact, the futures market is pricing three cuts before the end of the year – even though this is way ahead of what the Investment Banks and the Fed itself are forecasting and expecting.

Source: NBER, Bloomberg Finance LP, Haver Analytics, Deutsche Bank

Checking up on the economy: the bad

Let’s start with this chart with a very useful reminder: earnings do not survive recessions. So we absolutely must avoid one if we are to thrive. On top of that, the Fed is going to remain restrictive for a while. According to the chart below, it is unlikely that any reversion of the hiking course will take place this year, as Governor Powell has mentioned. The Fed will likely cut rates only in 2024 and beyond. The futures market is way ahead of this, seeing cuts this year – but one wonders if earlier cuts will be beneficial to the stock market, considering that the Fed might pivot only if inflation is firmly in check and if the economy starts to contract. At some point in time, those two forecasts will have to converge.

Source: Federal Reserve Board and Well Fargo Economics

The Citi Economic Surprise Index has been under pressure for a while, particularly for the Eurozone, which also has to contend with resilient inflation and with a Central Bank that has not finished hiking. For all it’s worth, the US Economy seems to be doing a little bit better this year than late last year, and will hopefully continue to do so.

Source: The Daily Shot, Bloomberg Finance LP

Checking up on the economy: the ugly

Valuation certainly isn’t cheap. It is even less so considering such appealing yields, particularly on the short end. This has led some to speculate that the current P/E is unsustainable. The current forward P/E of 18.0 is higher than the 10-Year average of 17.3. Hence earnings are of paramount importance and so is the performance of the economy and of that labor market which is Fed is watching closely. A spike in the Initial Jobless Claims could portend a reversal of the recent strength that we have witnessed in both the labor market and in unemployment (being unusually low).

Source: BLS, Department of Labor, J.P. Morgan

On the micro side, there seems evidence that credit conditions for US Consumers are much tighter than at any time in the recent past, even considering when the economy actually was in a recession. Monitoring retail sales is important to spot any early weakness by the US Consumer.

Source: University of Michigan, Haver Analytics, Apollo Chief Economist

Sentiment and what the market is telling us

The Fear and Greed Index is still in Greed territory, ending the week with a reading of 58, down from a previous reading of 59. It seems to move in synch with the market’s recent moves.

Source: CNN Business

A recent J.P. Morgan survey sees their clients thinking that the US Debt Ceiling won’t be a major issue. In the market, this has been taken more seriously by the T-Bills (spiking) rather than by the rest of the bond or equity markets. Hopefully, there will be a solution to this technical issue.

Source: J.P. Morgan

What are the Flows telling us?

It should be no surprise that there are positive flows to money market funds, even with a distinct choppiness in performance in the last few weeks. The current yields offered are attractive, and with the peak in rates coming soon, a very strong performance is within its sights. Usually, there is talk that surfaces calling for the Fed to cut rates based on the high inflows to money market funds, but I remain highly skeptical of that – they won’t stop until they feel their job (taming inflation) has been completed.

Source: BofA Global Investment Strategy, Bloomberg, MMFA Index

After the very positive results, it looks like tech is back in vogue. This has been underscored by the significant inflows of the last week, which echoed those of the 4-week average.

Source: BofA Securities

Earnings Review

Source: FactSet

The forward 12-month P/E ratio for the S&P 500 is 18.0x, down from last week’s reading of 17.7x, which is below the 5-year average at 18.6x but above the 10-year average at 17.3x. The present, bottom-up level ($221.11) is beginning to slip from Goldman Sachs’ top-down $224 forecast, but it did manage to reverse its course after 1Q23. As we have been going down steadily for a while, I just wonder if at some point down the year the US Corporates will find in them what it takes to reverse this trend, as forecasted to happen in the back half of the year.

For 1Q23 the blended EPS decline for the S&P500 on aggregate is -2.5%. If correct, it will mark the second consecutive quarter in which there has been an earnings contraction. The upward revision to 2Q23 earnings growth (-6.3%), has been surprisingly negative if compared to 31 Mar’s -4.7%, but it is still very early days. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 1.0% year on year, revised downwards from 1.2% last week, while revenue is forecasted to grow by 2.4% vs 2.1% on Mar 31.

Source: Factset

With estimates now measured against the forecasts as of Mar 31st, there are very few differences yet. Of note, Information Technology growth is negative by -1.1%. While Amazon issued weak guidance for AWS in April, all large tech companies made upbeat comments, so the softness is surprising.

Source: Factset

The S&P 500 has its revenue growth estimates at 2.3% revised downwards from last week at 2.4%. Financials are still leading the pack in terms of revenue forecasts. Information Technology revenue growth has been cut to 0.8% from 1.3% on Mar 31st. The sector seems to be doing better on the top than on the bottom line, perhaps signaling the reason for some of the layoffs.

Source: Factset

Let’s take a look at EPS for 2023 and 2024, which last week had the first upward revision in quite a while. The forecast for 2023 has now been updated to $221.11 from last week’s reading of $221.35; while 2024 is currently forecasted to be $246.33, compared to last week’s reading of $246.62.

Source: Factset

This is the detail for 2Q23. While the market might be more concerned about rates and recession than earnings at this point, the latter’s deterioration is continuing to get me worried as the downward revisions have been relentless and guidance very muted. It seems almost a miracle that the market managed to stay afloat with these shrinking earnings. 1Q23 is almost over, but 2Q23 looks to start much in the same fashion, with a significant earnings decline.

Earnings, What’s Next?

The earnings season is now entering in full its 1Q23 reports. Here’s a list of companies reporting this week. Highlights include Baidu (Tuesday, Before Open), Cisco (Wednesday, After Close), and Walmart (Thursday, Before Open).

Source: Earnings Whispers

Market Considerations

Source: Topdown Charts, Refinitiv Datastream

Revenue growth estimates for 2024 are forecasted to grow by 4.8% (5.0% on Mar 31st) and earnings growth estimates for 2024 are predicted to grow by 11.6% (12.1% on Mar 31st), so the future looks to be bright. While we continue to debate whether the US economy will fall into a recession or not and what will be the peak rates for Fed Funds, we should take note that almost every strategy has seen a more defensive positioning in the last month.

We are probably shifting from a monetary risk to a macro risk, where the performance of the economy is more important than what the Fed does. We should be mindful that the economy is probably just doing ok, even though passing the peak in rates will remove the overhang present on the market. If and when rates will diminish in importance, earnings (and top-line growth) will hopefully pick up their pace.

The chart above shows well the current situation we are in. The Nasdaq has been able to climb above its peak of 12,803.14 on 2nd February, and now it’s time for the S&P 500 to follow through (its peak is 4,179.76 on the same day). Despite being several pressures against Equities, tactically continue to suggest staying long on Equities, as long as the Nasdaq 100 stays above the Feb 2nd peak. Either the S&P and the Euro Stoxx 50 will be able to climb above their previous peak, which would open a new leg up for equities and for the market, or they won’t, and we fall in double-top territory with the markets possibly revisiting their recent lows. Regarding bonds, the trajectory is that yields will eventually fall, albeit with a few bumps on the road.

For the less volatility prone of you, it may make sense to take all opportunities to alter the weights of your asset allocation by increasing the weights of safety assets at the expense of more risky assets by lightening up in equities and reinvesting in bonds at attractive (approx 4%) yields. For those willing to look besides US treasuries, investment grade bonds (LQD ETF) could also be a good compromise: 1.2% pickup over government bonds for the safest part of the credit complex may still be compelling. 10-Year yields were turbulent last week, both in the US and Europe, though the ceiling should be near for both. For those wishing to keep their money in Equities with lower volatility, suggest switching to Japan as the company with the most stable outlook (the country with the more precise picture of rates at the moment) until rate perspectives become clearer in the US and Europe. They got a boost given the recent buy recommendation by Warren Buffett, and the oracle is very rarely wrong. So Japanese Equities are now investable regardless of the lower volatility derived by being the only nation in G7 not to raise rates in the current environment.

Happy trading and see you next week!

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics.

Leave a Reply